Deere (DE) Completes Acquisition of Sprayers Maker PLA

Agriculture equipment maker Deere & Company DE has completed the acquisition of PLA. The acquisition will assist Deere in providing innovative, cost-effective equipment, technology, and services to customers. Financial terms of the deal remain undisclosed.

In July 2018, Deere signed a definitive agreement to purchase PLA, a privately-held manufacturer of sprayers, planters, and specialty products for agriculture. Based in Argentina, PLA has 450 employees and manufacturing facilities in Las Rosas, Argentina, and Canoas, Brazil.

The PLA buyout is in sync with Deere’s focus on mergers and acquisitions which will help execute its crop-care strategy. Notably, Deere has purchased three sprayer companies in the last three years, as it acquired majority ownership in Iowa-based Hagie Manufacturing through a joint venture in 2016, and purchased Italian sprayer manufacturer Mazzotti in 2017.

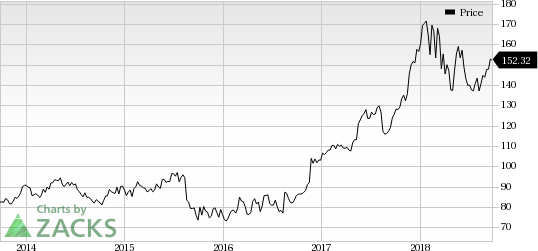

Deere & Company Price

Deere & Company Price | Deere & Company Quote

Moreover, Deere remains well placed for growth over the long term, based on steady investments in new products and geographies. In September 2017, the company acquired Blue River Technology. Following this, it acquired the world’s leading road-construction equipment maker — Wirtgen — in December. The buyout has significantly enhanced Deere's exposure to global transportation infrastructure.

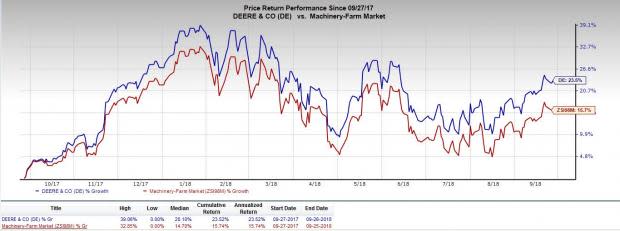

Deere’s shares have outperformed the industry over the past year. The stock has gained around 24%, while the industry has recorded growth of around 16% during the same time frame.

Zacks Rank & Key Picks

Deere carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector include Atkore International Group Inc. ATKR, Caterpillar Inc. CAT and Lawson Products, Inc. LAWS. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Atkore has an expected long-term growth rate of 10%. Its shares have gained 33% over the past year.

Caterpillar has an expected long-term growth rate of 15.6%. Its shares are up 23% in a year’s time.

Lawson Products has an expected long-term growth rate of 17.5%. Its shares have rallied 29% in the past year.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atkore International Group Inc. (ATKR) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Lawson Products, Inc. (LAWS) : Free Stock Analysis Report

To read this article on Zacks.com click here.