Delta (DAL) Improves Q4 Guidance, Expects Profits in 2022

Delta Air Lines DAL raised its guidance for the fourth quarter of 2021, backed by strong passenger demand during the holidays. Despite fears of Omicron-induced woes, the company hopes to generate “meaningful” profitability in 2022.

Per a SEC filing, DAL expects to generate an adjusted pre-tax profit of approximately $200 million in the December quarter. During the third-quarter earnings release in October, the airline had warned that rising fuel prices might put pressure on its ability to generate profits in the fourth quarter. The company had generated profits in the third quarter after incurring successive losses since the onset of the pandemic.

Delta expects adjusted total revenues (excluding third-party refinery sales) to be 74% recovered in the fourth quarter compared with the same period in 2019. Previously, the airline expected to generate total revenues in the low 70s (in percentage terms) compared with the 2019 level. The improved outlook is due to better-than-anticipated total revenue per available seat mile and positive passenger revenue per available seat mile (compared with 2019) on account of strong holiday period travel demand.

Non-fuel unit costs are estimated to increase approximately 7% in the December quarter from the 2019 level, compared with the previous guidance of an increase in the 6-8% range. Fuel price per gallon (adjusted) is predicted to be $2.05-$2.15 for the fourth quarter, compared with the previously guided range of $2.25-$2.40. Total capacity is still expected to be 80% of the 2019 level. While there is a limited impact from the Omicron variant in the fourth quarter, Delta’s international bookings have softened due to fresh travel restrictions.

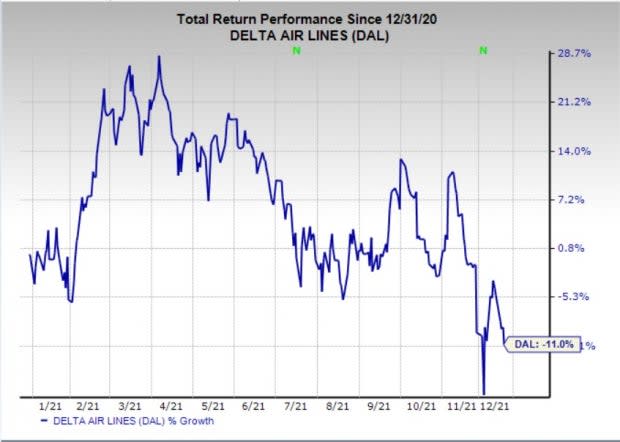

Amid the coronavirus-related uncertainty surrounding the recovery in air-travel demand, shares of Delta have declined 11% so far this year.

Image Source: Zacks Investment Research

DAL expects its capacity to reach approximately 90% of the 2019 level in 2022. It expects to attain pre-pandemic levels of capacity in 2023 and beyond. The company estimates earnings per share of more than $7 in 2024 on adjusted revenues (ex-refinery) of more than $50 billion.

Zacks Rank & Key Picks

Delta carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks within the broader Transportation sector:

ArcBest Corporation ARCB flaunts a Zacks Rank #1 (Strong Buy). The company has a stellar earnings surprise history. It has outperformed the Zacks Consensus Estimate for earnings in each of the preceding four quarters, the average surprise being 27.4%.You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of ArcBest have surged more than 100% so far this year.

Expeditors International of Washington EXPD carries a Zacks Rank #1. The company’s earnings have outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 29.1%.

Shares of Expeditors have appreciated more than 43% so far this year.

Schneider National SNDR carries a Zacks Rank #2 (Buy). The company’s earnings have trumped the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 21%.

Shares of Schneider National have rallied more than 25% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

ArcBest Corporation (ARCB) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research