Despite high Earnings, Analysts may be Seeing Limited Upside for Exxon Mobil's (NYSE:XOM) Stock

First published on Simply Wall St News on the 4th of August.

Summary:

XOM beat analysts EPS estimates by 7.8%, however future earnings may start declining after 2023.

Profitability is highly driven by energy prices, which may prove difficult to keep increasing.

The stock is already trading close to the 1-year price target, limiting the potential upside.

Exxon Mobil Corporation ( NYSE:XOM ) posted record Q2 earnings of $17.9b, amounting to $38.95 billion in the last 12 months. This marks a 227% YoY quarterly earnings growth. Investors that were bullish on XOM a year ago are getting a solid 60% return, however we need to analyze if the abnormal market conditions will persist - or if price tailwinds have reached their peak for this cycle.

Exxon Mobil's Earnings Analysis

When we look at the latest earnings report , we find that XOM has increased earnings mainly as a result of the price increase of energy , which led the company to nearly double its Q2 margin. Excluding this tailwind, the company would mark $9.474 in earnings, or a growth rate of 102%.

Diluted quarterly EPS was $4.14/$4.21, up 276% from a year ago. The result beat analysts Q2 $3.84 estimates by 7.8% , which partly accounts for the stock's gain last Friday. Cash flows also gained this quarter, and XOM made $49.289 billion in free cash flows in the last 12 months. The company also managed to have a good accrual ratio as cash flows are even higher than earnings. This helped build up the current high cash balance of $18.86 billion .

XOM's CEO described that "Earnings and cash flow benefited from increased production, higher realizations, and tight cost control,". It seems that management wants to justify higher valuation by pointing to the built-up efficiencies of the business. However, as we discussed previously, the high bump in earnings is mainly a price/margin effect and may not be sustainable in the future.

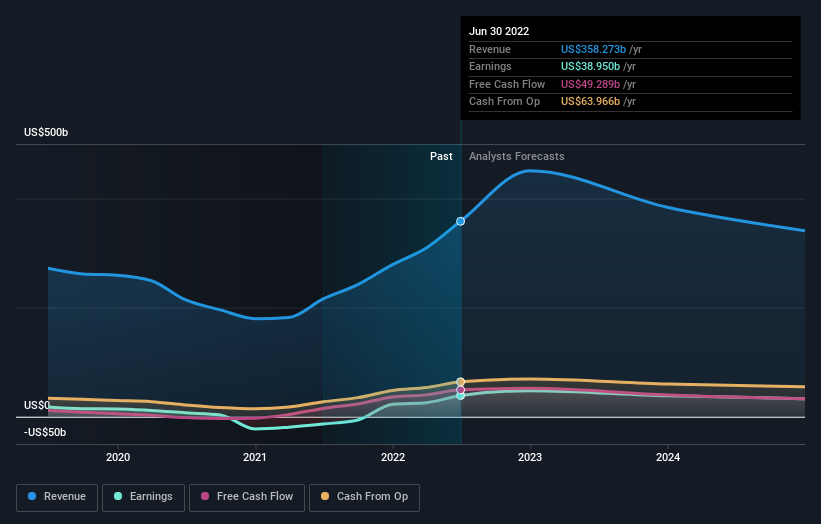

While predicting performance is very difficult, we can use analysts estimates in order to gain a better understanding of what may happen to the fundamentals of XOM. In the chart below, we can see the average analyst estimates for XOM's revenue, earnings and cash flows:

See our latest analysis for Exxon Mobil

We can see that Exxon Mobil's 19 analysts are estimating a peak in revenue and earnings in 2023, with a possible normalization in the year after. This indicates that much of the growth in the stock may already be "priced-in" by investors, leaving XOM at the late stages of their growth cycle.

In order for high-performance to persist, the company needs to keep receiving price tailwinds and management must use the cash position to invest in high return CapEx projects. Currently, XOM has a return on capital employed (ROCE) of 18.5% , up from 6.8% three years ago, and last quarter's CapEx was $4.6 billion, slightly down from the Q1 CapEx, but in-line with the 2022 guidance. It seems that the company is indeed increasing the value of operations , which may help with retaining the now higher valuation. According to XOM's 2022 guidance, the company projects to invest $21b - $23b in CapEx, meaning that they have about $13b left to invest and need to increase average quarterly CapEx to about $6.5b. Should the macro landscape change, management may decide to cut back on CapEx spending. Finally, we must keep in-mind, that the current political landscape is still strongly tilted against traditional energy sources, which can put companies like Exxon back on the uphill challenges they were facing in the last 10 years.

Exxon Mobil's Price Targets

Another important aspect to be aware of when evaluating a stock, is the forward price target. This gives investors information regarding the future potential of the stock as seen by sell-side analysts, as well as a comparison of the stock's performance vs the average price targets.

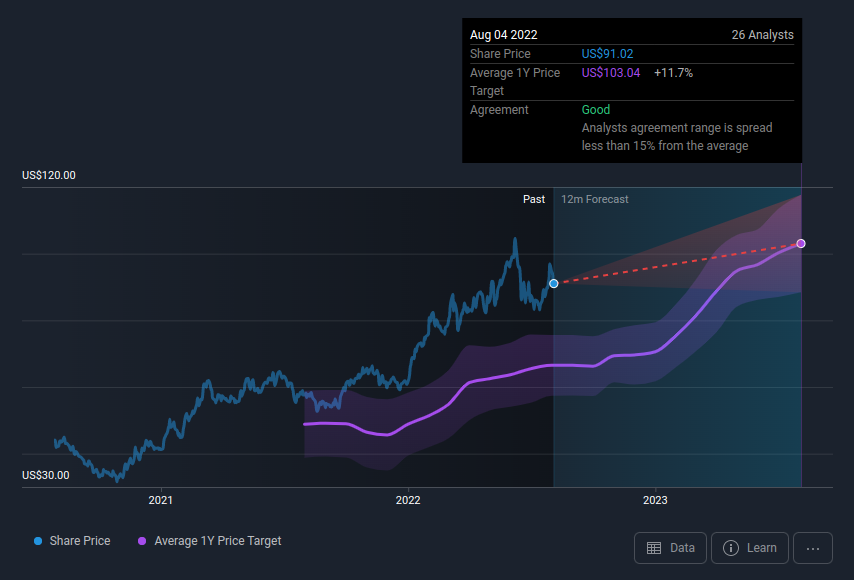

For XOM, the latest price target has been published on the 1st of August, and the figure is reported on by 26 analysts. It seems that historically, the stock does follow the price target trend and may be reaching a peak if analysts are congruent on earnings forecasts with the price target.

The current average price target for ExxonMobil is $103, indicating an 11.7% upside for investors. The most optimistic Exxon Mobil analyst has a price target of $134, while the most pessimistic values it at $77. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow .

In the chart below, we can see the historical relationship between the average 1-year price target and the stock price. Go to our full report to view the interactive chart.

Conclusion

Investors that predicted inflationary shocks and a surge in energy prices starting 2021 are now reaping the gains of their estimates. While we can't know at which stage energy prices are in the cycle, a reasonable assumption may be that they will either maintain their levels or stagnate. On the other hand, a notable factor that can keep pushing up prices, is the situation in Europe, where sourcing energy is currently very difficult.

As a company, Exxon has made some good calls during the past year, and investors benefited. It is now their opportunity to turn the gain in market cap and share into persistent value, and productively allocate the new capital. The company has also been making large operational expansions in Guyana , which investors may want to pay closer attention to.

The future earnings are expected to slowly normalize, which may lead to a stabilization or decline of XOM's price targets, so investors may need to build a new thesis before becoming highly bullish on the stock.

Before taking a next step, investors may want to review the 2 warning signs for Exxon Mobil we discovered, which back the possibility of the company peaking based on insider activity and the discussed fundamentals.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here