Despite Underwhelming Projections, Intel (NASDAQ:INTC) Offers a Mix of Yield and Growth

This article first appeared on Simply Wall St News.

After spending most of the year drifting downwards, Intel Corporation(NASDAQ: INTC) is getting back in the spotlight. The company is closing the important chip supply deal, while also looking to spin off its self-driving car unit. Meanwhile, it is trading below the price-to-earnings ratio of 10.

Check out our latest analysis for Intel.

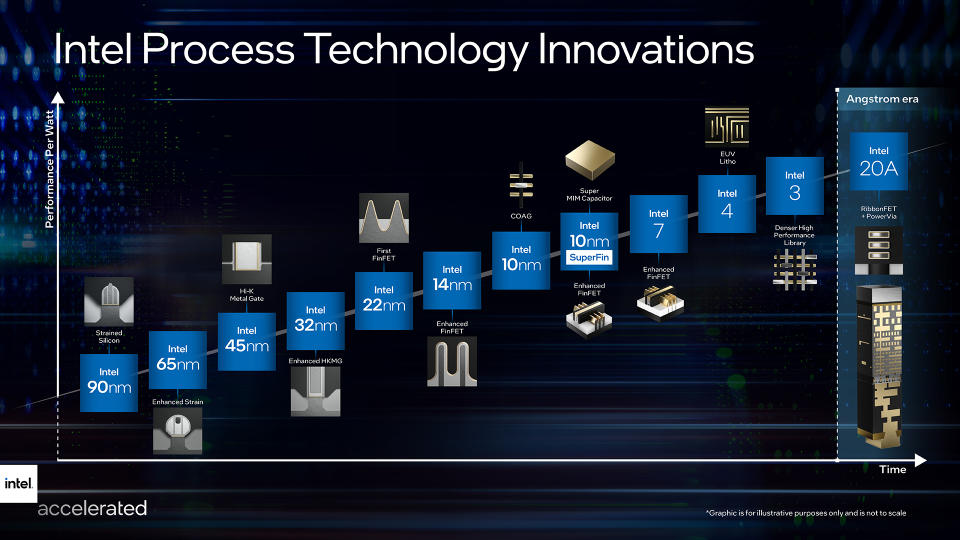

According to local reports, Intel wants to finalize the 3nm semiconductor deal with the Taiwan Semiconductor Manufacturing Company (TWSE:2330). TSMC's CEO, Dr.C.C.Wei, set the plan to enter mass production during the 2nd half of 2022. Meanwhile, Intel has plans for a 2nm node (20A) that should enter production as early as 2024.

Furthermore, 2 companies are allegedly working on a graphics processing unit (GPU) to help Intel solidify its place in that rapidly growing market.

It is worth noting that Intel is planning to publicly list shares in its self-driving car unit Mobileye. The company that Intel bought in 2017 for US$15.3b could now be valued over US$50b – 25% of Intel's total market cap. Intel plans to remain a majority owner, and the two companies will continue as strategic partners – pursuing the growth of computing in the automotive sector.

Trading Below the Market Average

With a price-to-earnings (or "P/E") ratio of 9.8x, Intel is trading way below the market, given that almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 37x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Intel could be doing better as it's been growing earnings less than most other companies lately. The P/E is probably low because investors think this lackluster earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture of analyst estimates for the company? Then our free report on Intel will help you uncover what's on the horizon.

How Is Intel's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Intel's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 59% in total over the last three years. Interestingly enough, the price has not been following that growth, as the stock is trading just 10% higher than 3 years ago.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 9.0% each year over the next three years. Meanwhile, the broader market is forecast to expand by 11% each year, which paints a poor picture.

In light of this, it's understandable that Intel's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

As we suspected, our examination of Intel's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage, investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio.

However, the company is working hard to improve its position in the growing markets (GPU) and has a promising plan for next-generation chip production. Furthermore, it pays a reliable 2.8% dividend - well above the industry average. Finally, it has Mobileye as a potential successful spin-off in an exciting and quickly growing industry that has already tripled in value since its acquisition. A positive development would certainly undo some of the negative earning growth projections.

To get more in-depth, you should also learn about this 1 warning sign we've spotted with Intel.

You might be able to find a better investment than Intel. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.