Detroit's Big 3 Knock it Out of the Park, but This Could be the Big Winner

Every month, we get a read on how many cars and trucks automakers sold. The latest metrics came on Wednesday, May 1, when we found out that April auto sales were the best they've been in six years. All three major U.S. automakers, Ford Motor (NYSE:F), General Motors (GM), and Chrysler, posted impressive double-digit year-over-year April sales gains, and Japanese auto giant Nissan also had a strong month.

The big driver for Ford, GM and Chrysler was a nice spike higher in pickup truck sales. Detroit's Big Three benefitted from a rush to replace aging trucks that many individuals, as well as small and medium sized businesses, had been waiting on since the Great Recession.

According to the company, Ford saw an overall vehicle sales increase of 18% in April 2013 versus April 2012. The company's popular F-Series pickup trucks saw an even better bump in sales, with a 24% year-over-year monthly increase.

GM saw a smaller, yet still impressive April sales gain of 11%, and once again, it was pickup trucks that led the way. The company's Chevrolet Silverado pickup sales rose 28% year-over-year during the month. It was the same story at Chrysler, with an 11% gain in April vehicle sales. The company's Ram pickup trucks logged an impressive 49% year-over-year gain during the month.

As for Japanese automakers, Nissan reported a 23% sales gain in April, while Honda Motor Corp. (HMC) saw a far more modest 7% April sales increase. The biggest automaker in the world, Toyota Motor (TM), was one of two major automakers that posted a sales decline in April, with vehicle sales falling 1%. And German auto giant Volkswagen saw a 10% drop.

Overall, the metrics in the auto space are quite encouraging, and the strong U.S. sales in April came despite a high unemployment rate and a sluggish domestic economy. One big positive helping to push auto sales higher is low-interest car loans.

Low borrowing costs have made access to capital more attractive than in the past, and according to the website Bankrate.com, the average four-year loan on a new car is just 2.4%. Low-interest car loans, as well as the need to replace an aging U.S. car fleet, is a one-two punch for continued strong auto sales going forward.

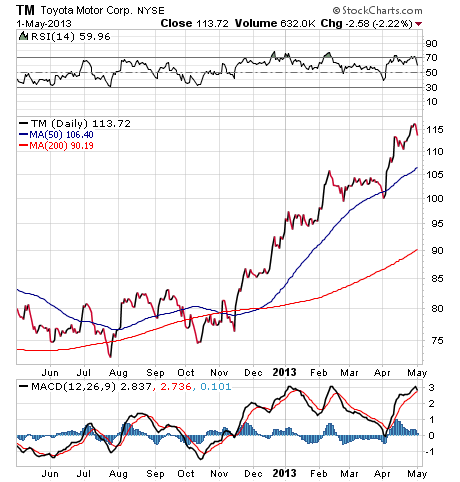

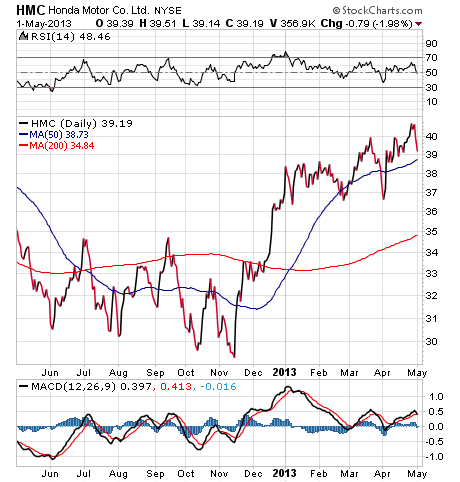

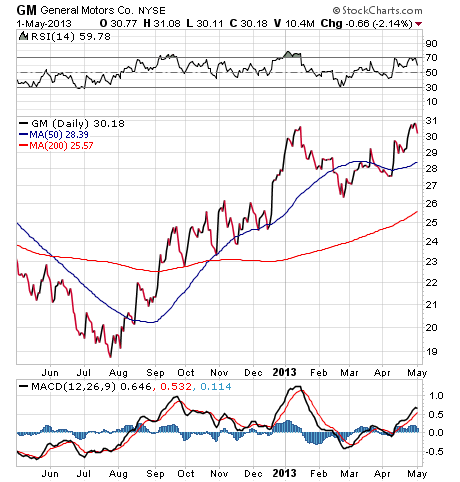

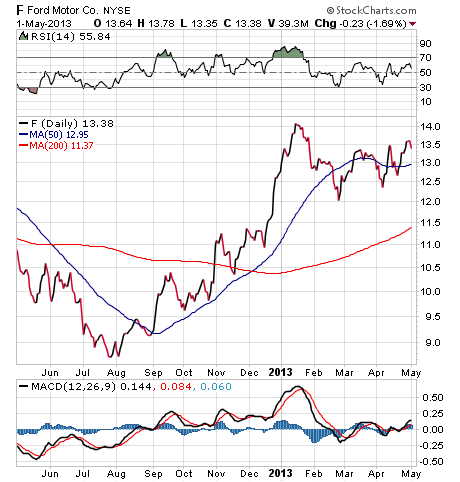

For investors, there's a basic question that needs to be asked. Is the current upward trend in auto sales something that's investable, or is the tank running low for the big names in the auto space? To help answer this question, let's turn to the charts of four of the biggest and most heavily traded auto stocks.

As you can see, investors have pushed TM higher over the past six months, bidding the stock up nearly 50% since November. Yet in Wednesday trade, shares tumbled more than 2%, pulled down by the broader market sell-off.

Honda shares also are up big since falling to their November low. The stock has spiked more than 30% during the past six months, and like TM, Honda shares remain well above both the short-term, 50-day and long-term, 200-day moving averages.

The world's second largest automaker, GM, hasn't enjoyed such lofty gains. During the past six months, shares of the American icon are up a laudable 20%, but that didn't include the May 1 slide in the shares of 2.14%.

As for fellow U.S. carmaker Ford, its shares are up nearly 22% over the past half year, a move that closely resembles the upside we've seen in GM.

Clearly, all four of these auto stocks have driven higher over the past six months, and though their momentum has slowed in recent months, particularly in GM and F, all of the big guns in the space look like they're poised to continue delivering nice upside.

So, which one of these stocks do I think has the best upside potential? My favorite here is GM.

On Thursday, May 2, GM shares spiked more than 5% to a new 52-week high, after the company posted stronger-than-expected fiscal first-quarter profits. Excluding one-time charges, GM's adjusted earnings came in at $0.67 per share, well above consensus forecasts for an adjusted profit of $0.54.

After reading GM's earnings report, the big takeaway for me was how well the company did in struggling Europe. Although there was a loss of $175 million in Europe, compared with a loss of $294 million a year earlier, it was much smaller than the $469 million loss that Wall Street analysts had been expecting.

I suspect that if economic conditions in Europe improve, and if GM can stay the course here in its core U.S. market, as well as in emerging markets such as China, we can easily see this stock soar past its IPO price of $33 and upward into the mid-to-high-$30 range by the time GM reports Q2 earnings.

Related Articles

Quick Rally Could Take This Chemicals Stock to New Highs

Buffett vs. Gundlach: Who Will Win the Bond Battle?

If I Could Buy Only Two Bill Gates Picks, These Would Be Them