Develop North (LON:DVNO) Has Affirmed Its Dividend Of £0.01

Develop North PLC's (LON:DVNO) investors are due to receive a payment of £0.01 per share on 30th of June. This payment means the dividend yield will be 4.9%, which is below the average for the industry.

View our latest analysis for Develop North

Develop North Is Paying Out More Than It Is Earning

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, the company was paying out 210% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

EPS is set to fall by 14.4% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 213%, which could put the dividend under pressure if earnings don't start to improve.

Develop North's Dividend Has Lacked Consistency

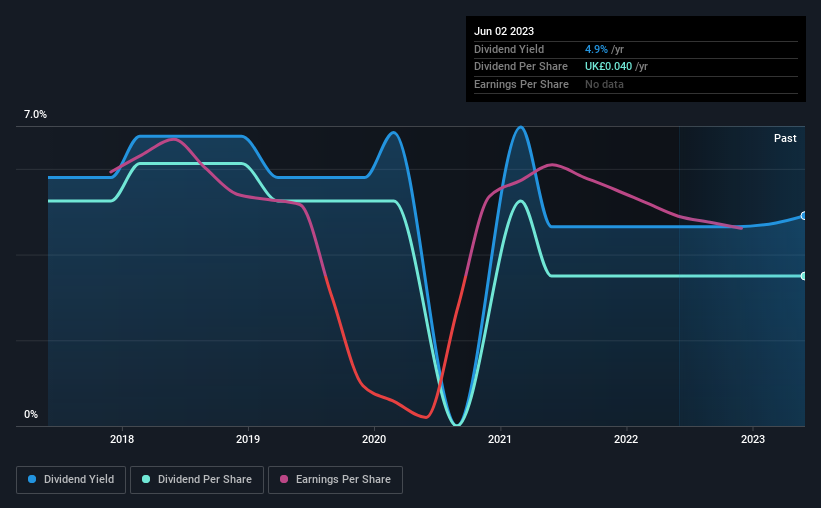

It's comforting to see that Develop North has been paying a dividend for a number of years now, however it has been cut at least once in that time. This suggests that the dividend might not be the most reliable. Since 2017, the dividend has gone from £0.06 total annually to £0.04. The dividend has shrunk at around 6.5% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Develop North's EPS has fallen by approximately 14% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

We're Not Big Fans Of Develop North's Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, this doesn't get us very excited from an income standpoint.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 4 warning signs for Develop North (2 are concerning!) that you should be aware of before investing. Is Develop North not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here