Is DFS Stock A Buy or Sell?

Last year we predicted the arrival of the first US recession since 2009 and we told in advance that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Discover Financial Services (NYSE:DFS).

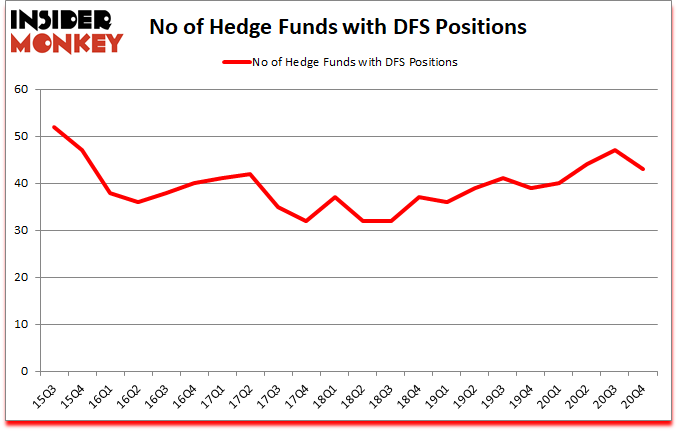

Is DFS stock a buy or sell? Discover Financial Services (NYSE:DFS) was in 43 hedge funds' portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 52. DFS has experienced a decrease in support from the world's most elite money managers in recent months. There were 47 hedge funds in our database with DFS positions at the end of the third quarter. Our calculations also showed that DFS isn't among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's monthly stock picks returned 197% since March 2017 and outperformed the S&P 500 ETFs by more than 124 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Paul Reeder of PAR Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let's view the fresh hedge fund action surrounding Discover Financial Services (NYSE:DFS).

Do Hedge Funds Think DFS Is A Good Stock To Buy Now?

At the end of December, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DFS over the last 22 quarters. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Discover Financial Services (NYSE:DFS) was held by Eminence Capital, which reported holding $168.6 million worth of stock at the end of December. It was followed by Alua Capital Management with a $112.8 million position. Other investors bullish on the company included East Side Capital (RR Partners), KG Funds Management, and Columbus Hill Capital Management. In terms of the portfolio weights assigned to each position East Side Capital (RR Partners) allocated the biggest weight to Discover Financial Services (NYSE:DFS), around 10.79% of its 13F portfolio. Alua Capital Management is also relatively very bullish on the stock, designating 7.89 percent of its 13F equity portfolio to DFS.

Because Discover Financial Services (NYSE:DFS) has experienced a decline in interest from the aggregate hedge fund industry, it's safe to say that there were a few funds who sold off their full holdings heading into Q1. It's worth mentioning that Eashwar Krishnan's Tybourne Capital Management sold off the biggest investment of the "upper crust" of funds tracked by Insider Monkey, valued at about $290.7 million in stock. Snehal Amin's fund, Windacre Partnership, also said goodbye to its stock, about $278.5 million worth. These moves are important to note, as total hedge fund interest was cut by 4 funds heading into Q1.

Let's go over hedge fund activity in other stocks similar to Discover Financial Services (NYSE:DFS). These stocks are Southwest Airlines Co. (NYSE:LUV), Corning Incorporated (NYSE:GLW), Splunk Inc (NASDAQ:SPLK), NatWest Group plc (NYSE:NWG), Nutrien Ltd. (NYSE:NTR), Willis Towers Watson Public Limited Company (NASDAQ:WLTW), and Mettler-Toledo International Inc. (NYSE:MTD). This group of stocks' market caps match DFS's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position LUV,55,757534,4 GLW,39,334973,3 SPLK,47,1036156,3 NWG,3,759,1 NTR,25,754698,-1 WLTW,58,3245691,7 MTD,29,850200,-1 Average,36.6,997144,2.3 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.6 hedge funds with bullish positions and the average amount invested in these stocks was $997 million. That figure was $730 million in DFS's case. Willis Towers Watson Public Limited Company (NASDAQ:WLTW) is the most popular stock in this table. On the other hand NatWest Group plc (NYSE:NWG) is the least popular one with only 3 bullish hedge fund positions. Discover Financial Services (NYSE:DFS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DFS is 62.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Hedge funds were also right about betting on DFS, though not to the same extent, as the stock returned 5.2% since Q4 (through March 19th) and outperformed the market as well.

Get real-time email alerts: Follow Discover Financial Services (NYSE:DFS)

Disclosure: None. This article was originally published at Insider Monkey.

Follow Insider Monkey on Twitter

Related Content