Can Diagnostic Revenues Drive PerkinElmer (PKI) Q3 Earnings?

PerkinElmer, Inc's PKI third-quarter 2018 results, expected to release after markets close on Oct 31, are likely to reflect steady growth in the core Diagnostics business. Meanwhile, a raised earnings view for 2018 is pretty encouraging.

Q2 Results at a Glance

In the last reported quarter, PerkinElmer posted adjusted earnings of 91 cents per share, beating the Zacks Consensus Estimate by 5.8%.

Sales totaled $703.4 million, which surpassed the Zacks Consensus Estimate of $693.8 million.

The company has an average positive earnings surprise of 3.4% for the trailing four quarters.

Which Way Are Estimates Treading?

For the quarter to be reported, the Zacks Consensus Estimate for earnings per share is pegged at 92 cents, showing a year-over-year increase of 26%. The same for revenues stands at $674.4 million, reflecting growth of 21.7% year over year.

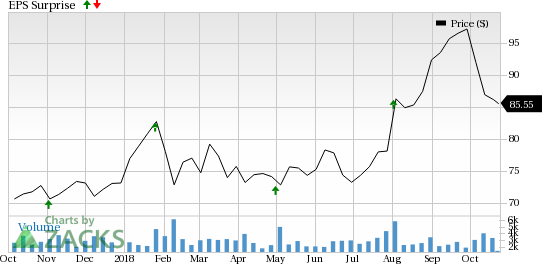

PerkinElmer, Inc. Price and EPS Surprise

PerkinElmer, Inc. Price and EPS Surprise | PerkinElmer, Inc. Quote

Let’s see how things are shaping up before the earnings results.

Diagnostics Revenues to Drive Q3

Diagnostic revenues have been fortifying the company’s market position in terms of exclusiveness of services. The company offers products that are used to detect genetic disorders. PerkinElmer also provides digital x-ray flat panel detectors and infectious disease testing solutions in its Diagnostics portfolio.

The segment accounted for 38.8% of total revenues in the last reported quarter. It also grew 10% organically. Adjusted operating income in the segment totaled $77.2 million.

It is encouraging to note that for the third quarter, the Zacks Consensus Estimate for the segment’s revenues is pinned at $275 million, showing a year-over-year rise of 62.7%.

Management remains optimistic about the EUROIMMUN acquisition which drove Diagnostics revenues in the last reported quarter. In fact, for 2018, the company expects sales worth $370 million from EUROIMMUN.

Other Factors at Play

DAS — a Key Contributor

PerkinElmer has formulated a ‘DAS Growth Strategy’ that focuses on finalizing the organizational changes associated with the life sciences business under the Discovery & Analytical Solutions (DAS) segment.

The company has consistently experienced strong customer uptake of both new imaging and analytical instrumentation in the DAS business.

For the quarter to be reported, the Zacks Consensus Estimate for the segment’s revenues is pegged at $400 million, showing a year-over-year rise of 3.9%.

2018 Outlook Raised

For 2018, PerkinElmer expects adjusted earnings of $3.65 per share, which is significantly higher than the previously estimated $3.60. Notably, the Zacks Consensus Estimate for the same is currently pegged at $3.65, in line with the company’s estimate.

What Does Our Model Say?

Per our proven model, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to deliver a positive earnings surprise in the quarter. This is precisely the case here.

Earnings ESP: PerkinElmer has an Earnings ESP of +1.45%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PerkinElmer carries a Zacks Rank #3.

Please note that we caution against stocks with a Zacks Rank #4 (Sell) or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revision.

Other Stocks Worth a Look

Here are a few other medical stocks worth considering as they also have the right combination of elements to post an earnings beat this quarter.

McKesson Corporation MCK has an Earnings ESP of +0.17% and a Zacks Rank #3.

Becton, Dickinson and Company BDX has an Earnings ESP of +0.43% and a Zacks Rank #3.

Masimo Corporation MASI has an Earnings ESP of +0.98% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PerkinElmer, Inc. (PKI) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research