Diamond Hill Capital Cuts Charles Schwab, Texas Instruments

- By Tiziano Frateschi

Diamond Hill Capital (Trades, Portfolio) sold shares of the following stocks during the first quarter of 2021, which ended on March 31.

TJX Companies

The guru's TJX Companies Inc. (TJX) position was reduced by 89.59%, impacting the portfolio by -1.55%.

The off-price retailer has a market cap of $85.41 billion and an enterprise value of $90.44 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 1.69% and return on assets of 0.33% are underperforming 53% of companies in the retail, cyclical industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.68.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 1.24% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.66% and Spiros Segalas (Trades, Portfolio) with 0.54%.

Charles Schwab

The guru curbed the position in Charles Schwab Corp. (SCHW) by 27.07%, impacting the portfolio by -0.48%.

The company, which operates in the brokerage, banking and asset-management businesses, has a market cap of $132.13 billion and an enterprise value of $113.15 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 11.05% is outperforming 68% of companies in the capital markets industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 2.96 is below the industry median of 3.05.

The largest guru shareholders of the company include Dodge & Cox with 4.52% of outstanding shares, PRIMECAP Management (Trades, Portfolio) with 1.51% and Al Gore (Trades, Portfolio) with 1.49%.

Texas Instruments

The firm trimmed its position in Texas Instruments Inc. (TXN) by 35.21%. The trade had an impact of -0.48% on the portfolio.

The company, which manufactures analog chips, has a market cap of $165.34 billion and an enterprise value of $164.90 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 71.77% and return on assets of 33.58% are outperforming 98% of companies in the semiconductors industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 1.07.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 2.53% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 0.43% and Chris Davis (Trades, Portfolio) with 0.37%.

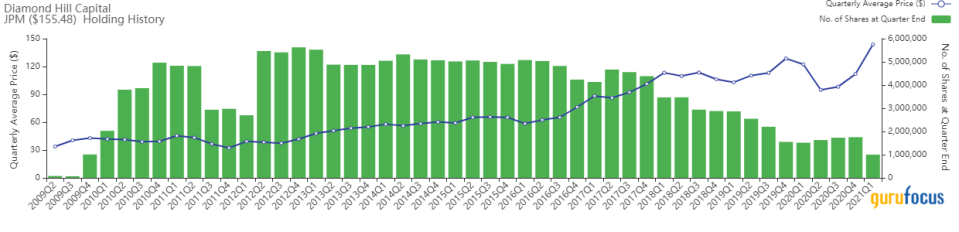

JPMorgan

The guru curbed the position in JPMorgan Chase & Co. (JPM) by 24.91%, impacting the portfolio by -0.45%.

The U.S. financial institution has a market cap of $470.65 billion and an enterprise value of $399.56 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 14.31% and return on assets of 1.22% are outperforming 75% of companies in the banks industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 1.53.

The largest guru shareholders of the company include PRIMECAP Management (Trades, Portfolio) with 0.47% of outstanding shares, Dodge & Cox with 0.40% and Andreas Halvorsen (Trades, Portfolio) with 0.28%.

BorgWarner

The firm reduced its position in BorgWarner Inc. (BWA) by 21.35%, impacting the portfolio by -0.40%.

The company has a market cap of $11.59 billion and an enterprise value of $14.24 billion.

GuruFocus gives the company a profitability and growth rating of 8out of 10. The return on equity of 9.91% and return on assets of 4.43% are outperforming 74% of companies in the vehicles and parts industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.41.

The largest guru shareholder of the company is Diamond Hill Capital (Trades, Portfolio) with 3.34% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.81% and John Rogers (Trades, Portfolio) with 0.71%.

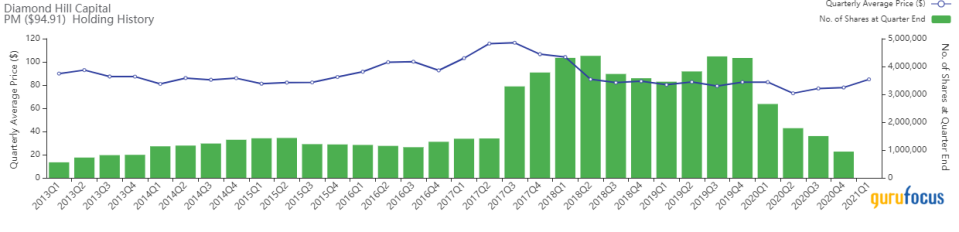

Philip Morris

The guru exited the position in Philip Morris International Inc. (PM), impacting the portfolio by -0.37%.

The tobacco company has a market cap of $147.92 billion and an enterprise value of $175.39 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on assets of 21.58% are outperforming 78% of companies in the tobacco products industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.13.

The largest guru shareholders of the company include First Eagle Investment (Trades, Portfolio) with 0.67% of outstanding shares, Tom Russo (Trades, Portfolio) with 0.54%, Rogers with 0.28% and the MS Global Franchise Fund (Trades, Portfolio) with 0.19%.

Disclosure: I do not own any stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.