Diamond Hill Capital Trades Devon for Chevron

Diamond Hill Capital (Trades, Portfolio) recently disclosed its portfolio updates for the fourth quarter of 2019.

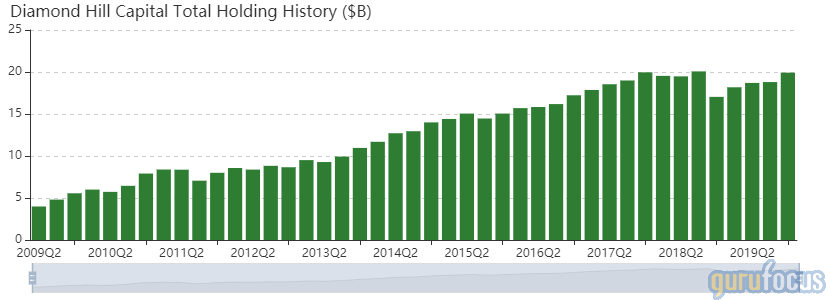

Founded in 2000 and headquartered in Columbus, Ohio, Diamond Hill Capital identifies itself as an independent investment management firm that seeks to align employee interests with investor interests by investing in the same portfolios. Its strategy is to maintain a long-term focus based on fundamental, ground-up analysis of a company's intrinsic value, as determined by factors such as market position, competition, management, valuation and growth prospects. The funds focus on buying undervalued companies that have a solid and proven foundation for revenue production. As of the quarter's end, Diamond Hill's equity portfolio is valued at $19.92 billion.

Based on the above criteria, the firm's biggest sells for the quarter were Devon Energy Corp. (NYSE:DVN) and JPMorgan Chase & Co. (NYSE:JPM), while its biggest buys were Chevron Corp. (NYSE:CVX) and Charles Schwab Corp. (NYSE:SCHW).

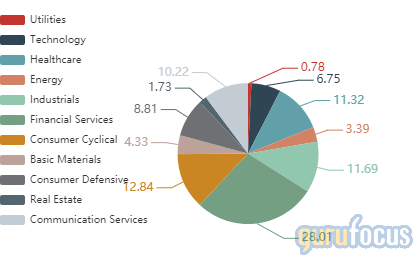

The firm's top holdings are Citigroup Inc. (NYSE:C) at 3.64% of the equity portfolio, Alphabet Inc. (NASDAQ:GOOGL) at 2.87% and Abbott Laboratories (NYSE:ABT) at 2.78%. Diamond Hill's largest sectors in terms of weight are financial services (28.01%), consumer cyclical (12.84%) and industrials (11.69%).

Devon Energy

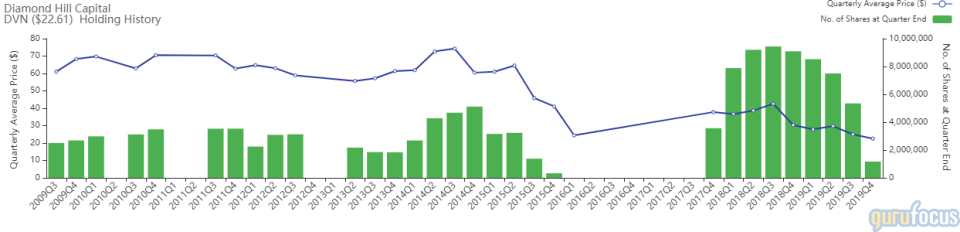

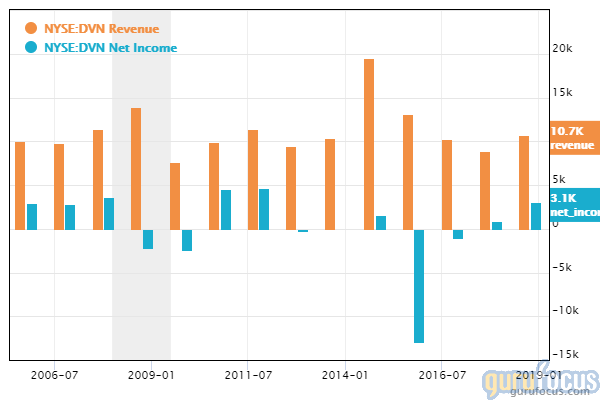

Diamond Hill sold 4,180,577 shares of Devon Energy, reducing its position in the company by 78.14%. The traded impacted the equity portfolio by -0.53%. Shares of Devon Energy traded at an average price of $22.57 during the quarter.

Devon Energy is an oil and natural gas exploration company headquartered in Oklahoma City. It focuses mainly on U.S. onshore operations and currently seeks to optimize profits by cutting costs and selling non-core assets.

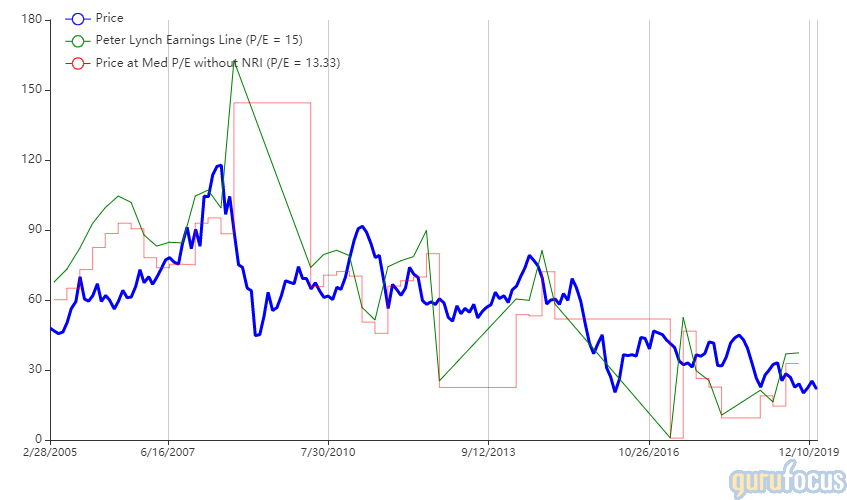

As of Feb. 10, Devon Energy has a market cap of $8.71 billion, a price-earnings ratio of 7.02 and a price-book ratio of 1.33. According to the Peter Lynch chart, shares are trading slightly below their fair value.

GuruFocus has assigned Devon Energy a financial strength rating of 4 out of 10 and a profitability rating of 5 out of 10. Factors such as a favorable debt-to-Ebitda ratio of 1.28 and an operating margin of 17.9% are balanced with drawbacks such as a low Altman-Z score of 2.22 and a three-year annual revenue decline of 12.6%.

The energy sector as a whole has not done well over the past 12 months, with energy stocks underperforming all other components of the S&P 500. Downward price pressures from oil and natural gas oversupply and international political and trade tensions have cut into the profits of energy companies. Devon Energy has also seen its revenue decline in recent years, even as net income continues to recover from a $12.89 billion loss in 2016.

Chevron

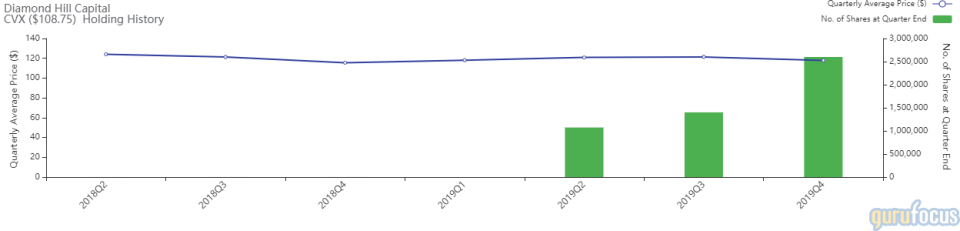

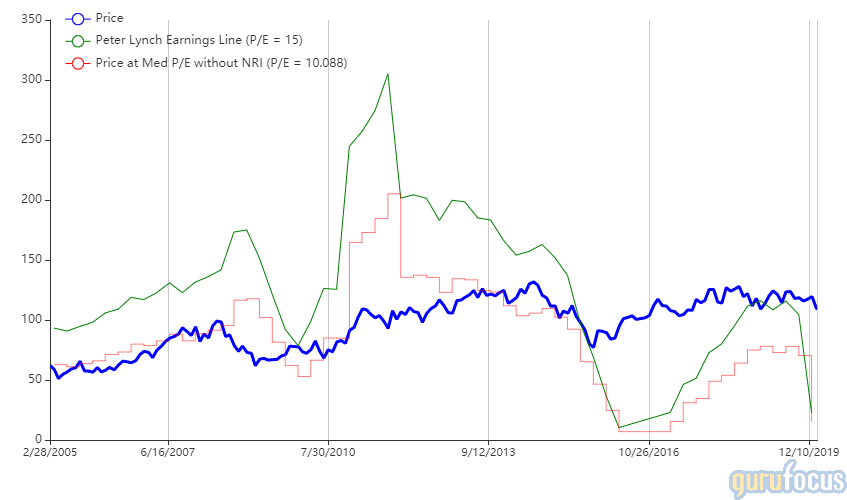

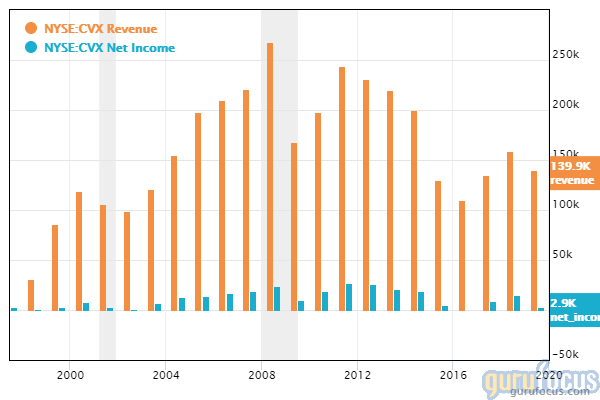

The firm invested in 1,198,821 more shares of Chevron, increasing its stake in the company by 85.58% and impacting the equity portfolio by 0.72%. Chevron shares traded at an average price of $117.86 during the quarter.

Chevron is a San Ramon, California-based multinational energy company. It has a strong balance sheet and is in a phase of expansion.

As of Feb. 10, Chevron has a market cap of $205.69 billion, a price-earnings ratio of 72.04 and a price-book ratio of 1.42. According to the Peter Lynch chart, shares of the company are overvalued.

Chevron has a GuruFocus financial strength rating of 6 out of 10 and a profitability rating of 6 out of 10. Positive signs include no debt, an equity-to-asset ratio of 0.61 and a three-year revenue growth rate of 7.8%.

Like Devon Energy, Chevron faces headwinds from downward price pressures in the energy sector. However, Chevron recently announced a $20 billion capital and exploratory budget for 2020 as it seeks to increase its holdings. The principle of "buy low, sell high" can work for companies just as much as it can for investors of common stock, so if Chevron can acquire assets at a lower valuation now, it may be a good sign for future revenues. Chevron's sales may also be boosted by its production of low-sulfur refined fuels for marine ships, which it is producing to help companies comply with the new regulation that all ocean-going ships must ensure that their exhaust fumes from burning fuel are no more than 0.5% sulfur.

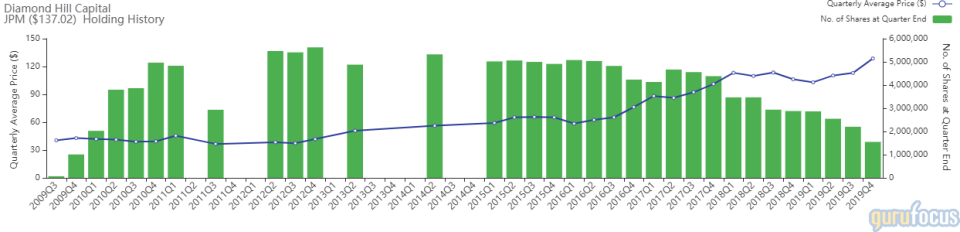

JPMorgan Chase

Diamond Hill decreased its stake in JPMorgan by 652,430 shares, or -29.62%. The trade had a -0.41% impact on the equity portfolio. Shares of the company traded at an average price of $128.65 during the quarter.

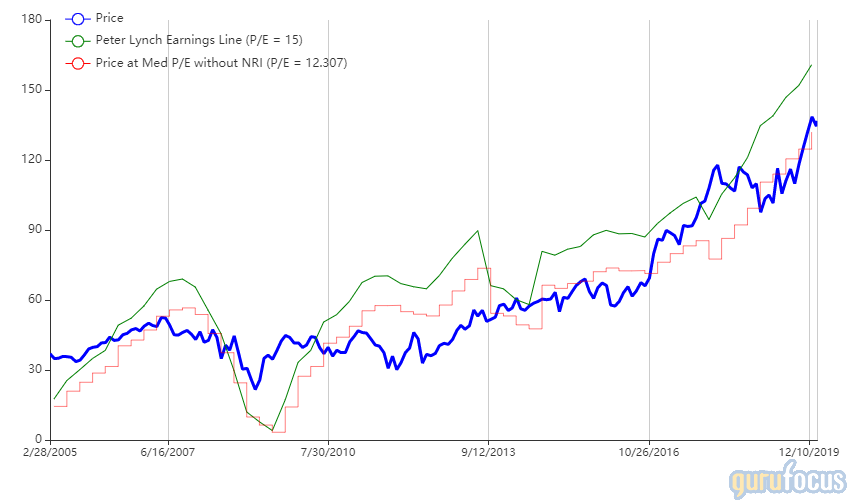

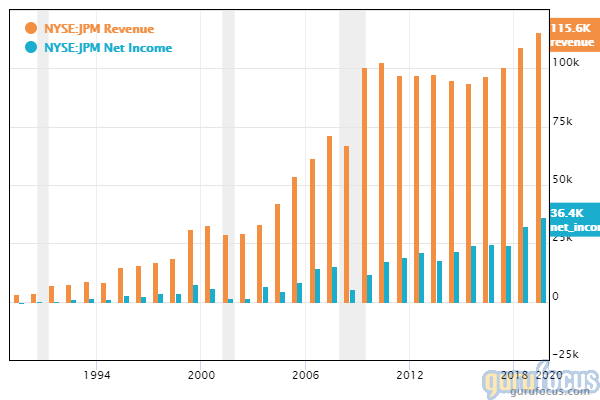

JPMorgan is the largest bank in the U.S. and the sixth-largest bank in the world. In addition to providing traditional banking services, it is also an investment bank, with $2.68 trillion in assets under management.

As of Feb. 10, JPMorgan has a market cap of $423 billion, a price-earnings ratio of 12.79 and a price-sales ratio of 3.96. According to the Peter Lynch chart, shares are trading near their fair value.

JPMorgan has a GuruFocus financial strength score of 3 out of 10 and a profitability score of 4 out of 10. Over the past three years, its revenue has grown approximately 8.8% per year.

As a large-scale bank, JPMorgan has found low federal interest rates to be as profitable as not. Loans have lost an average of 2% of interest income for the bank, but this was more counteracted by an increase in the amount of consumer and commercial loans due to said lower interest. In its fourth-quarter 2019 earnings report, the bank also reported an 86% increase in fixed-income trading, a 15% increase in equity trading, a 6% increase in investment banking and an 8% increase in asset and wealth management. Meanwhile, consumer and community banking was up 3%, counteracted by a 3% loss in commercial banking.

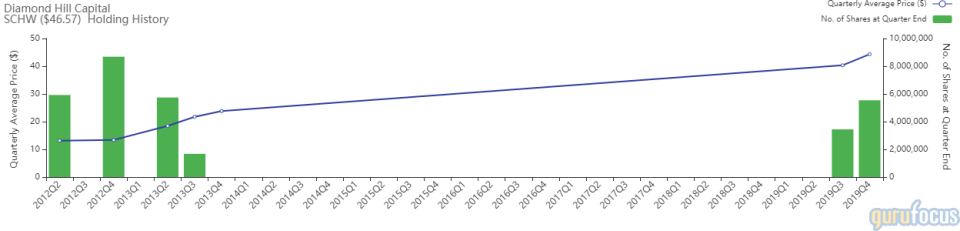

Charles Schwab

The firm increased its stake in Charles Schwab by 2,094,259 shares, or 60.76%. The trade impacted the equity portfolio by 0.50%. During the quarter, shares traded at an average price of $44.34.

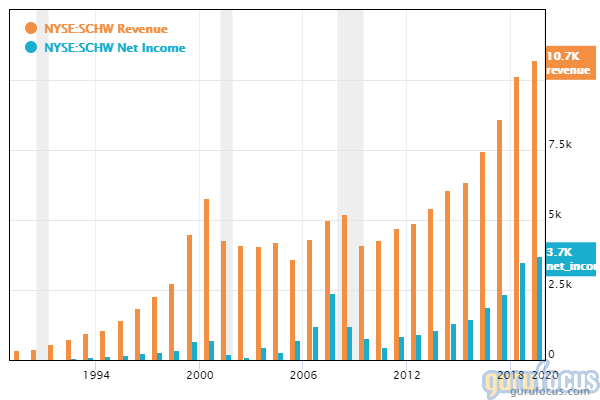

Charles Schwab is a financial services company that offers a wide range of products, from mutual funds and bonds to options and futures. Approximately 1.7 million people participate in its corporate retirement plan, and the total amount of client money invested in its proprietary mutual funds and exchange-traded funds currently exceeds $450.2 billion.

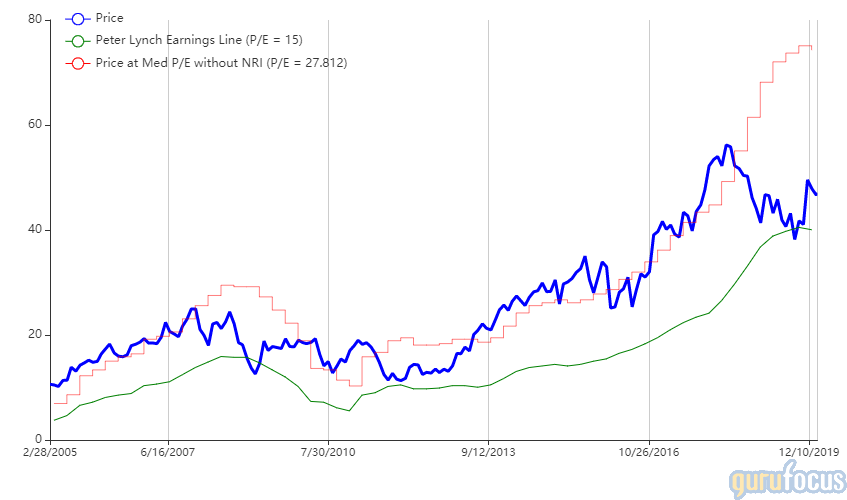

As of Feb. 10, Charles Schwab has a market cap of $60.44 billion, a price-earnings ratio of 17.51 and a price-sales ratio of 5.79. According to the Peter Lynch chart, the stock is trading slightly above its fair value.

Charles Shwab has a GuruFocus financial strength rating of 4 out of 10 and a profitability rating of 5 out of 10. Over the past three years, revenue has grown approximately 15.8% per year.

Schwab's top and bottom lines were both negatively impacted by the elimination of commissions for stock and ETF trading. However, the company sees this change as necessary in order to stay competitive with newer, online-only rivals. The temporary hit to Schwab's earnings and stock price may provide a good entry point for investors. In addition, the company has entered into a definitive agreement to acquire rival discount broker TD Ameritrade (NASDAQ:AMTD), which may further drive growth.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

Steven Romick Ups Short-Selling in 4th Quarter

Top 4th-Quarter Buys of Chuck Royce's Firm

Bristol-Myers Squibb Smashes Earnings Predictions Following Celgene Acquisition

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.