Diamond Hill Continues to Buy Baidu, Deere

Independent investment management firm Diamond Hill Capital (Trades, Portfolio) bought shares of the following stocks in both the second and third quarters.

Baidu Inc. (NASDAQ:BIDU)

The firm increased its position by 52.32% in the second quarter and then raised it by 31.86% in the third quarter. The stock has a weight of 0.01% in the portfolio.

The Chinese search engine has a market cap of $38.30 billion. Its revenue of $15.47 billion has grown at an average rate of 20.90% per annum over the last five years.

Dodge & Cox is the largest guru shareholder of the company with 2.37% of outstanding shares, followed by Sarah Ketterer (Trades, Portfolio) with 1.52% and David Herro (Trades, Portfolio) with 1.01%.

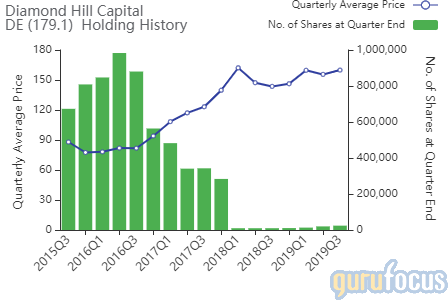

Deere & Co. (NYSE:DE)

The firm increased its holding by 51.11% in the second quarter and added 20.64% in the third quarter. The stock has a weight of 0.02% in the portfolio.

The company, which produces agricultural, turf, construction and forestry machinery, has a market cap of $56.39 billion. Its revenue of $12.19 billion has grown at an average annual rate of 1.50% over the last five years.

The company's largest guru shareholder is First Eagle Investment (Trades, Portfolio) with 1.51% of outstanding shares, followed by Al Gore (Trades, Portfolio) with 1.50% and PRIMECAP Management (Trades, Portfolio) with 0.79%.

Fastenal Co. (NASDAQ:FAST)

Diamond Hill boosted its holding by 76.08% in the second quarter and by 32.06% in the third quarter. The stock has a total weight of 0.01% in the portfolio.

The company, which operates in the Industrial Distribution industry, has a market cap of $21.39 billion. Its revenue of $5.28 billion has grown 8.30% on average every year over the last five years.

Mairs and Power (Trades, Portfolio) is the largest guru shareholder of the company with 0.89% of outstanding shares, followed by David Rolfe (Trades, Portfolio) with 0.34%, Pioneer Investments (Trades, Portfolio) with 0.27% and Ron Baron (Trades, Portfolio) with 0.17%.

KKR & Co. Inc. (NYSE:KKR)

In the second quarter, the firm increased its stake by 50.43% and then raised it by 23.92% in the third quarter. The stock has a weight of 1.28% in the portfolio.

The company, which operates in the asset management industry, has a market cap of $24.43 billion. Its revenue of $2.97 billion has grown 19.30% on average every year over the last five years.

The largest guru shareholder of the company is Jeff Ubben (Trades, Portfolio)'s ValueAct with 6.02% of outstanding shares, followed by Chuck Akre (Trades, Portfolio) with 1.51% and Richard Pzena (Trades, Portfolio) with 1.01%.

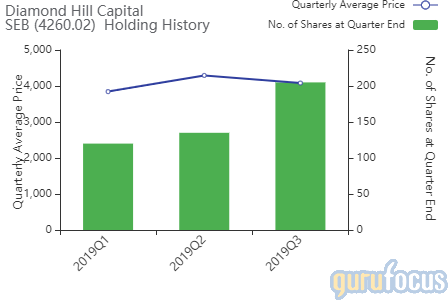

Seaboard Corp. (SEB)

The firm bolstered its position by 12.5% in the second quarter and by 51.85% in the third quarter.

The company, which operates in the food production and transportation businesses, has a market cap of $4.96 billion. Its revenue of $6.69 billion has fallen at an average annual rate of 0.90% over the last five years.

The largest guru shareholder of the company is Kahn Brothers (Trades, Portfolio) with 1.14% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.60% and Third Avenue Management (Trades, Portfolio) with 0.15%.

SVB Financial Group (NASDAQ:SIVB)

In the second quarter, the firm increased its position by 2.15% and then boosted it by 75.94% in the third quarter. The stock has a weight of 0.46% in the portfolio.

The loans and ancillary financial services provider has a market cap of $12.27 billion. Its revenue of $3.12 billion has grown 10.0% on average every year over the last five years.

The largest guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 1.95% of outstanding shares, followed by Pioneer Investments with 0.97% and Louis Moore Bacon (Trades, Portfolio) with 0.10%.

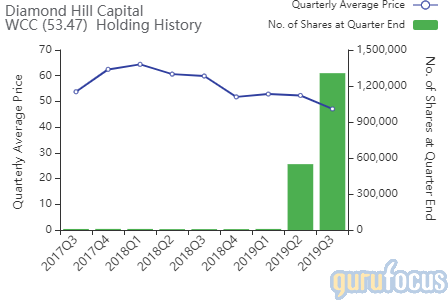

WESCO International Inc. (NYSE:WCC)

Diamond Hill boosted its position by 6,102.83% in the second quarter and by 138.16% in the third quarter. The stock has a weight of 0.33% in the portfolio.

The company, which operates in the industrial distribution industry, has a market cap of $2.23 billion. Its revenue of $8.27 billion has grown at an average annual rate of 3.50% over the last five years.

Another notable guru shareholder of the company is Simons' firm with 0.97% of outstanding shares, followed by Robert Olstein (Trades, Portfolio) with 0.38%, Bernard Horn (Trades, Portfolio) with 0.24% and Hotchkis & Wiley with 0.19%.

Zynga Inc. (NASDAQ:ZNGA)

In the second quarter, the firm boosted its holding by 176.74% and added 8% in the third quarter.

The company, which develops games, has a market cap of $5.91 billion. Its revenue of $1.16 billion has grown 0.70% on average every year over the last five years.

The largest guru shareholder of the company is Simons' firm with 2.06% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 0.16% and Paul Tudor Jones (Trades, Portfolio) with 0.09%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Kahn Brothers Trims Merck, Exits Sterling Bancorp

Donald Smith Trims Kinross Gold, Micron Technology Positions

Tom Gayner Continues to Buy Alphabet, Amazon

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.