Did Aberdeen International Inc (TSE:AAB) Create Value For Shareholders?

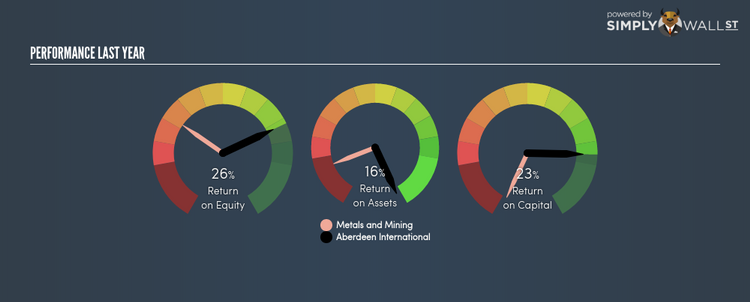

With an ROE of 26.37%, Aberdeen International Inc (TSX:AAB) outpaced its own industry which delivered a less exciting 7.18% over the past year. While the impressive ratio tells us that AAB has made significant profits from little equity capital, ROE doesn’t tell us if AAB has borrowed debt to make this happen. In this article, we’ll closely examine some factors like financial leverage to evaluate the sustainability of AAB’s ROE. Check out our latest analysis for Aberdeen International

What you must know about ROE

Return on Equity (ROE) weighs Aberdeen International’s profit against the level of its shareholders’ equity. For example, if the company invests CA$1 in the form of equity, it will generate CA$0.26 in earnings from this. Generally speaking, a higher ROE is preferred; however, there are other factors we must also consider before making any conclusions.

Return on Equity = Net Profit ÷ Shareholders Equity

Returns are usually compared to costs to measure the efficiency of capital. Aberdeen International’s cost of equity is 17.24%. Since Aberdeen International’s return covers its cost in excess of 9.13%, its use of equity capital is efficient and likely to be sustainable. Simply put, Aberdeen International pays less for its capital than what it generates in return. ROE can be broken down into three different ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

The first component is profit margin, which measures how much of sales is retained after the company pays for all its expenses. Asset turnover shows how much revenue Aberdeen International can generate with its current asset base. And finally, financial leverage is simply how much of assets are funded by equity, which exhibits how sustainable the company’s capital structure is. Since ROE can be artificially increased through excessive borrowing, we should check Aberdeen International’s historic debt-to-equity ratio. Currently, Aberdeen International has no debt which means its returns are driven purely by equity capital. Therefore, the level of financial leverage has no impact on ROE, and the ratio is a representative measure of the efficiency of all its capital employed firm-wide.

What this means for you:

Are you a shareholder? AAB’s ROE is impressive relative to the industry average and also covers its cost of equity. Since its high ROE is not likely driven by high debt, it might be a good time to top up on your current holdings if your fundamental research reaffirms this analysis. If you’re looking for new ideas for high-returning stocks, you should take a look at our free platform to see the list of stocks with Return on Equity over 20%.

Are you a potential investor? If AAB has been on your watch list for a while, making an investment decision based on ROE alone is unwise. I recommend you do additional fundamental analysis by looking through our most recent infographic report on Aberdeen International to help you make a more informed investment decision.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.