Did Allied Motion Technologies Inc (NASDAQ:AMOT) Create Value For Investors Over The Past Year?

This article is intended for those of you who are at the beginning of your investing journey and looking to gauge the potential return on investment in Allied Motion Technologies Inc (NASDAQ:AMOT).

Allied Motion Technologies Inc (NASDAQ:AMOT) generated a below-average return on equity of 10.07% in the past 12 months, while its industry returned 11.22%. AMOT’s results could indicate a relatively inefficient operation to its peers, and while this may be the case, it is important to understand what ROE is made up of and how it should be interpreted. Knowing these components could change your view on AMOT’s performance. Today I will look at how components such as financial leverage can influence ROE which may impact the sustainability of AMOT’s returns. View out our latest analysis for Allied Motion Technologies

Breaking down ROE — the mother of all ratios

Return on Equity (ROE) weighs Allied Motion Technologies’s profit against the level of its shareholders’ equity. An ROE of 10.07% implies $0.10 returned on every $1 invested. Generally speaking, a higher ROE is preferred; however, there are other factors we must also consider before making any conclusions.

Return on Equity = Net Profit ÷ Shareholders Equity

Returns are usually compared to costs to measure the efficiency of capital. Allied Motion Technologies’s cost of equity is 10.70%. Since Allied Motion Technologies’s return does not cover its cost, with a difference of -0.63%, this means its current use of equity is not efficient and not sustainable. Very simply, Allied Motion Technologies pays more for its capital than what it generates in return. ROE can be split up into three useful ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

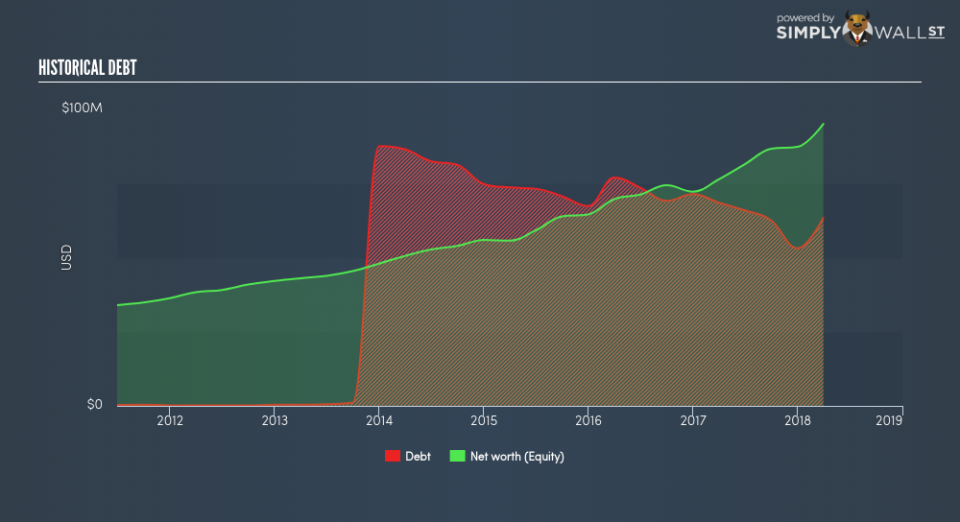

The first component is profit margin, which measures how much of sales is retained after the company pays for all its expenses. Asset turnover reveals how much revenue can be generated from Allied Motion Technologies’s asset base. Finally, financial leverage will be our main focus today. It shows how much of assets are funded by equity and can show how sustainable the company’s capital structure is. Since financial leverage can artificially inflate ROE, we need to look at how much debt Allied Motion Technologies currently has. Currently the debt-to-equity ratio stands at a reasonable 66.66%, which means its ROE is driven by its ability to grow its profit without a significant debt burden.

Next Steps:

While ROE is a relatively simple calculation, it can be broken down into different ratios, each telling a different story about the strengths and weaknesses of a company. Allied Motion Technologies exhibits a weak ROE against its peers, as well as insufficient levels to cover its own cost of equity this year. However, ROE is not likely to be inflated by excessive debt funding, giving shareholders more conviction in the sustainability of returns, which has headroom to increase further. ROE is a helpful signal, but it is definitely not sufficient on its own to make an investment decision.

For Allied Motion Technologies, there are three pertinent aspects you should further research:

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Valuation: What is Allied Motion Technologies worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Allied Motion Technologies is currently mispriced by the market.

Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Allied Motion Technologies? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.