Did Business Growth Power Chimerix's (NASDAQ:CMRX) Share Price Gain of 141%?

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Chimerix, Inc. (NASDAQ:CMRX) share price has soared 141% in the last year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 81% in about a quarter. However, the stock hasn't done so well in the longer term, with the stock only up 15% in three years.

View our latest analysis for Chimerix

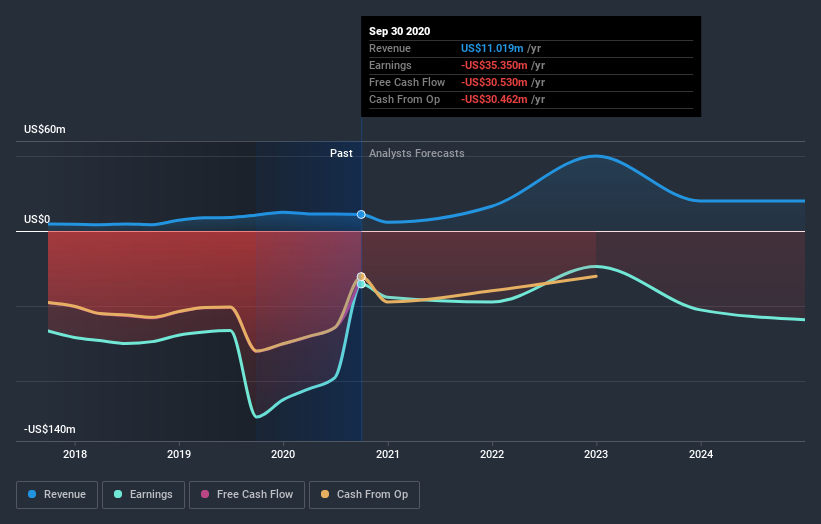

Because Chimerix made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Chimerix grew its revenue by 3.6% last year. That's not a very high growth rate considering it doesn't make profits. So we wouldn't have expected the share price to rise by 141%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Chimerix stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Chimerix has rewarded shareholders with a total shareholder return of 141% in the last twelve months. That certainly beats the loss of about 4% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Chimerix better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Chimerix (of which 1 makes us a bit uncomfortable!) you should know about.

Chimerix is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.