Did Changing Sentiment Drive ADF Group's (TSE:DRX) Share Price Down A Worrying 58%?

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term ADF Group Inc. (TSE:DRX) shareholders. Sadly for them, the share price is down 58% in that time. Contrary to the longer term story, the last month has been good for stockholders, with a share price gain of 8.7%.

See our latest analysis for ADF Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, ADF Group moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

The modest 1.6% dividend yield is unlikely to be guiding the market view of the stock. Revenue is actually up 14% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching ADF Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

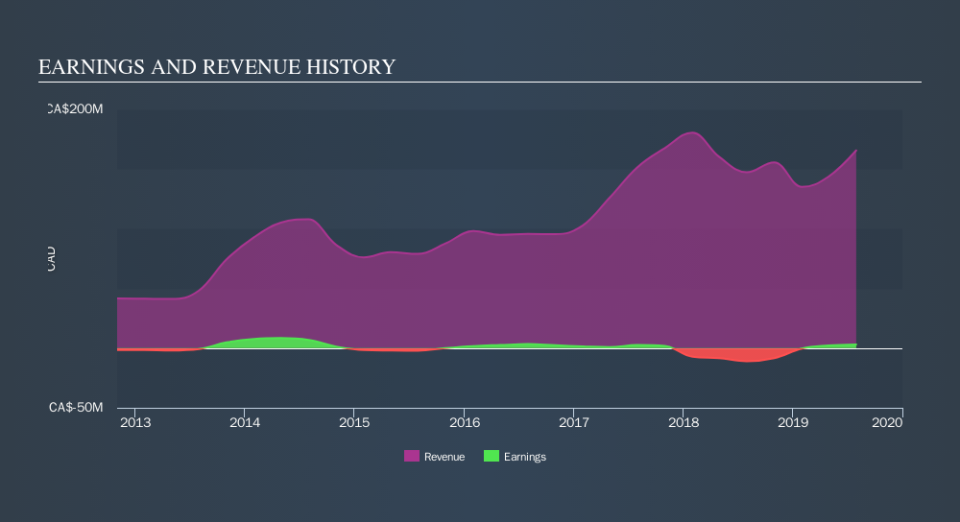

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We've already covered ADF Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for ADF Group shareholders, and that cash payout explains why its total shareholder loss of 57%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 5.1% in the last year, ADF Group shareholders lost 16% (even including dividends) . Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before forming an opinion on ADF Group you might want to consider these 3 valuation metrics.

Of course ADF Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.