Did Changing Sentiment Drive CTI BioPharma's (NASDAQ:CTIC) Share Price Down A Painful 94%?

CTI BioPharma Corp. (NASDAQ:CTIC) shareholders should be happy to see the share price up 17% in the last month. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 94% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for CTI BioPharma

CTI BioPharma recorded just US$2,705,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that CTI BioPharma comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. CTI BioPharma has already given some investors a taste of the bitter losses that high risk investing can cause.

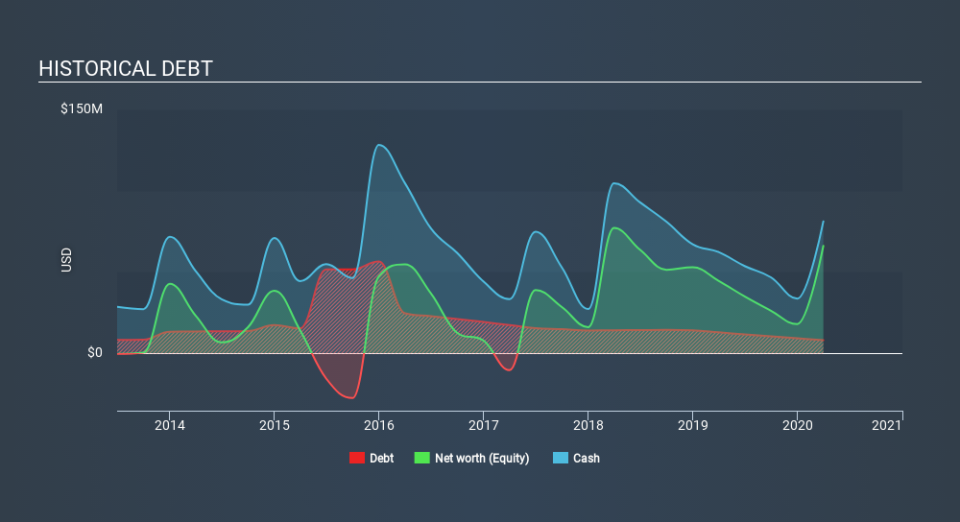

When it last reported its balance sheet in March 2020, CTI BioPharma had cash in excess of all liabilities of US$59m. That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price down 43% per year, over 5 years , it seems likely that the need for cash is weighing on investors' minds. You can click on the image below to see (in greater detail) how CTI BioPharma's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

It's good to see that CTI BioPharma has rewarded shareholders with a total shareholder return of 22% in the last twelve months. That certainly beats the loss of about 43% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 6 warning signs for CTI BioPharma you should be aware of, and 1 of them is a bit concerning.

Of course CTI BioPharma may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.