Did Changing Sentiment Drive Cyanotech's (NASDAQ:CYAN) Share Price Down By 49%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Cyanotech Corporation (NASDAQ:CYAN), since the last five years saw the share price fall 49%. And we doubt long term believers are the only worried holders, since the stock price has declined 33% over the last twelve months. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

View our latest analysis for Cyanotech

Cyanotech isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Cyanotech saw its revenue increase by 0.2% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 13% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

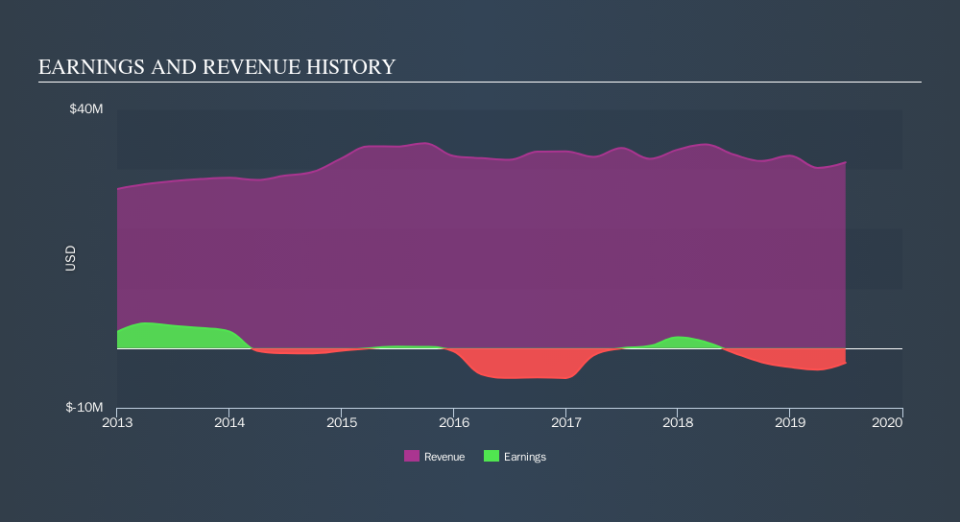

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Cyanotech's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Cyanotech had a tough year, with a total loss of 33%, against a market gain of about 8.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Cyanotech may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.