Did Changing Sentiment Drive Medalist Diversified REIT's (NASDAQ:MDRR) Share Price Down A Worrying 62%?

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that Medalist Diversified REIT, Inc. (NASDAQ:MDRR) stock has had a really bad year. The share price has slid 62% in that time. Because Medalist Diversified REIT hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 32% in about a quarter. That's not much fun for holders.

See our latest analysis for Medalist Diversified REIT

Medalist Diversified REIT wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Medalist Diversified REIT saw its revenue grow by 26%. That's definitely a respectable growth rate. Meanwhile, the share price tanked 62%, suggesting the market had much higher expectations. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

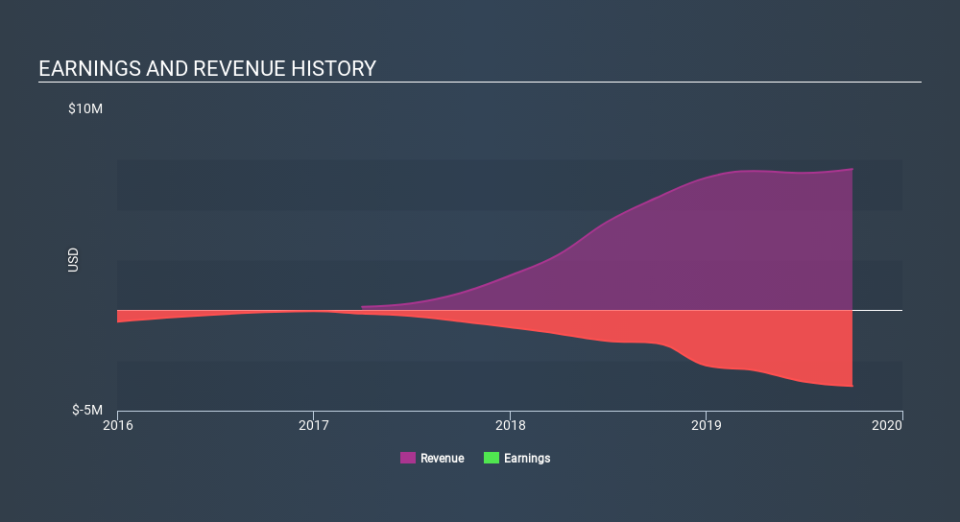

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Medalist Diversified REIT's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Medalist Diversified REIT the TSR over the last year was -56%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While Medalist Diversified REIT shareholders are down 56% for the year (even including dividends) , the market itself is up 6.5%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 32%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Medalist Diversified REIT (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

But note: Medalist Diversified REIT may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.