Did Changing Sentiment Drive Qutoutiao's (NASDAQ:QTT) Share Price Down By 45%?

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Qutoutiao Inc. (NASDAQ:QTT) share price is down 45% in the last year. That's well bellow the market return of 20%. Qutoutiao may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 30% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Qutoutiao

Because Qutoutiao is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Qutoutiao grew its revenue by 326% over the last year. That's a strong result which is better than most other loss making companies. The share price drop of 45% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

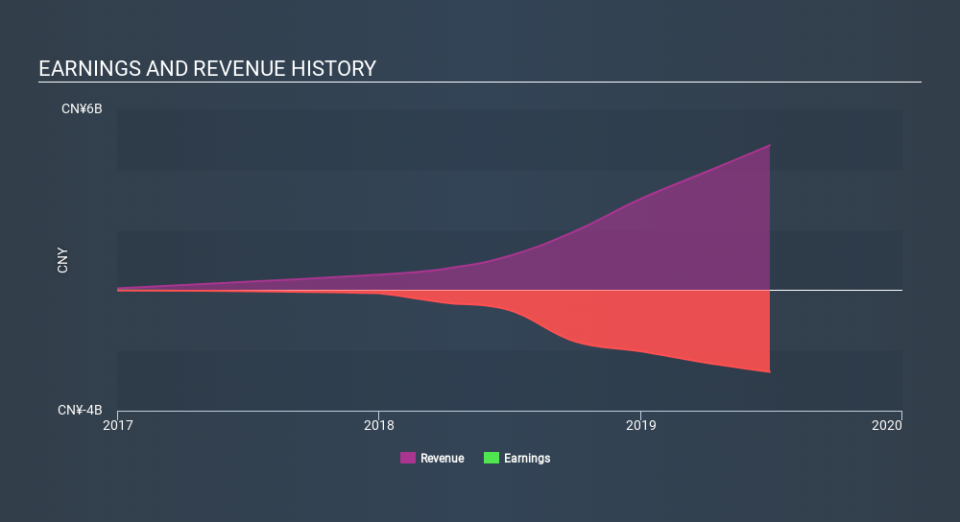

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Qutoutiao stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 20% in the last year, Qutoutiao shareholders might be miffed that they lost 45%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 30% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of Qutoutiao's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.