Did Hedge Funds Drop The Ball On Cypress Semiconductor Corporation (CY) ?

Is Cypress Semiconductor Corporation (NASDAQ:CY) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

Is Cypress Semiconductor Corporation (NASDAQ:CY) a buy, sell, or hold? Money managers are becoming more confident. The number of bullish hedge fund bets went up by 2 lately. Our calculations also showed that cy isn't among the 30 most popular stocks among hedge funds.

To the average investor there are many methods stock traders employ to value stocks. A duo of the most under-the-radar methods are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the elite fund managers can outpace their index-focused peers by a superb amount (see the details here).

Let's take a look at the key hedge fund action surrounding Cypress Semiconductor Corporation (NASDAQ:CY).

How are hedge funds trading Cypress Semiconductor Corporation (NASDAQ:CY)?

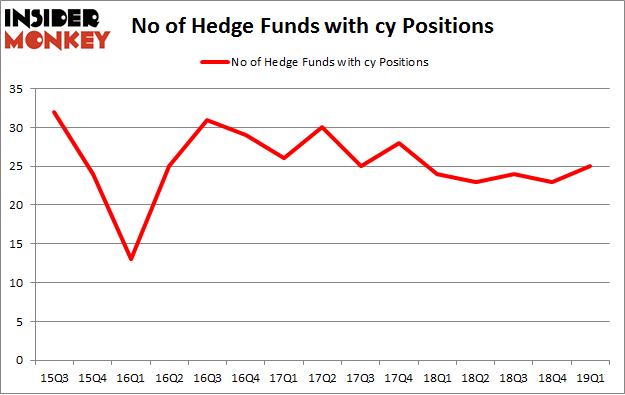

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CY over the last 15 quarters. With hedge funds' sentiment swirling, there exists an "upper tier" of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Cypress Semiconductor Corporation (NASDAQ:CY), with a stake worth $32.2 million reported as of the end of March. Trailing Renaissance Technologies was AQR Capital Management, which amassed a stake valued at $31.4 million. Alyeska Investment Group, Millennium Management, and GAMCO Investors were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers were leading the bulls' herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the largest position in Cypress Semiconductor Corporation (NASDAQ:CY). Marshall Wace LLP had $12.1 million invested in the company at the end of the quarter. Howard Marks's Oaktree Capital Management also initiated a $7.3 million position during the quarter. The other funds with brand new CY positions are Daryl Smith's Kayak Investment Partners, Tor Minesuk's Mondrian Capital, and Ian Simm's Impax Asset Management.

Let's now review hedge fund activity in other stocks similar to Cypress Semiconductor Corporation (NASDAQ:CY). These stocks are The New York Times Company (NYSE:NYT), New York Community Bancorp, Inc. (NYSE:NYCB), AngloGold Ashanti Limited (NYSE:AU), and Watsco Inc (NYSE:WSO). All of these stocks' market caps resemble CY's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position NYT,32,1168693,0 NYCB,12,86969,-3 AU,23,356908,11 WSO,18,137568,4 Average,21.25,437535,3 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $438 million. That figure was $225 million in CY's case. The New York Times Company (NYSE:NYT) is the most popular stock in this table. On the other hand New York Community Bancorp, Inc. (NYSE:NYCB) is the least popular one with only 12 bullish hedge fund positions. Cypress Semiconductor Corporation (NASDAQ:CY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CY as the stock returned 19.9% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index