Did Hedge Funds Drop The Ball On Sabra Health Care REIT Inc (SBRA) ?

At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we've gathered as a result gives us access to a wealth of collective knowledge based on these firms' portfolio holdings as of June 28. In this article, we will use that wealth of knowledge to determine whether or not Sabra Health Care REIT Inc (NASDAQ:SBRA) makes for a good investment right now.

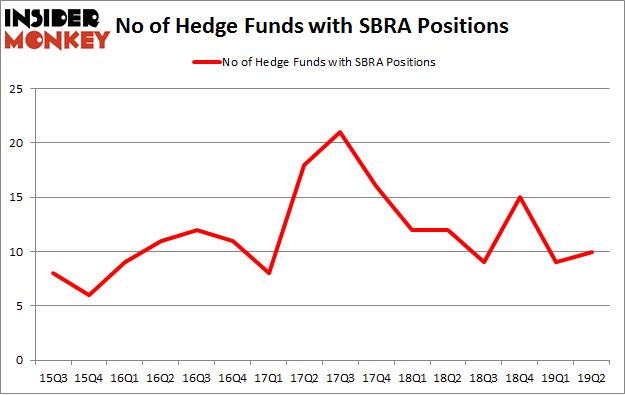

Sabra Health Care REIT Inc (NASDAQ:SBRA) investors should pay attention to an increase in enthusiasm from smart money of late. Our calculations also showed that SBRA isn't among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We're going to take a look at the fresh hedge fund action regarding Sabra Health Care REIT Inc (NASDAQ:SBRA).

What does smart money think about Sabra Health Care REIT Inc (NASDAQ:SBRA)?

At the end of the second quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in SBRA a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Balyasny Asset Management, managed by Dmitry Balyasny, holds the biggest position in Sabra Health Care REIT Inc (NASDAQ:SBRA). Balyasny Asset Management has a $11.3 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Forward Management, managed by J. Alan Reid, Jr., which holds a $10.3 million position; the fund has 1.8% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions comprise Ken Griffin's Citadel Investment Group, Israel Englander's Millennium Management and Benjamin A. Smith's Laurion Capital Management.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Sabra Health Care REIT Inc (NASDAQ:SBRA) headfirst. Millennium Management, managed by Israel Englander, assembled the largest position in Sabra Health Care REIT Inc (NASDAQ:SBRA). Millennium Management had $4.3 million invested in the company at the end of the quarter. Benjamin A. Smith's Laurion Capital Management also made a $1.8 million investment in the stock during the quarter. The following funds were also among the new SBRA investors: Kamran Moghtaderi's Eversept Partners and Claes Fornell's CSat Investment Advisory.

Let's now take a look at hedge fund activity in other stocks similar to Sabra Health Care REIT Inc (NASDAQ:SBRA). We will take a look at Laureate Education, Inc. (NASDAQ:LAUR), Valley National Bancorp (NASDAQ:VLY), Telephone and Data Systems, Inc. (NYSE:TDS), and DNP Select Income Fund Inc. (NYSE:DNP). This group of stocks' market caps are closest to SBRA's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position LAUR,23,427225,2 VLY,11,10337,0 TDS,25,393297,2 DNP,1,455,-1 Average,15,207829,0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $208 million. That figure was $36 million in SBRA's case. Telephone and Data Systems, Inc. (NYSE:TDS) is the most popular stock in this table. On the other hand DNP Select Income Fund Inc. (NYSE:DNP) is the least popular one with only 1 bullish hedge fund positions. Sabra Health Care REIT Inc (NASDAQ:SBRA) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on SBRA as the stock returned 19.1% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019