Did Hedge Funds Drop The Ball On 58.com Inc (WUBA) ?

Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors' money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

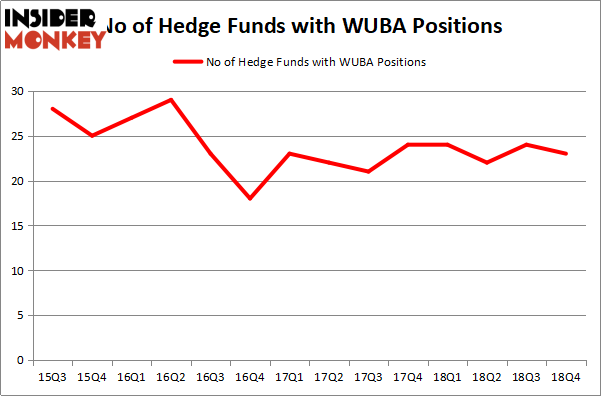

58.com Inc (NYSE:WUBA) investors should pay attention to a decrease in hedge fund sentiment lately. WUBA was in 23 hedge funds' portfolios at the end of the fourth quarter of 2018. There were 24 hedge funds in our database with WUBA positions at the end of the previous quarter. Our calculations also showed that WUBA isn't among the 30 most popular stocks among hedge funds.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to check out the key hedge fund action encompassing 58.com Inc (NYSE:WUBA).

How are hedge funds trading 58.com Inc (NYSE:WUBA)?

At the end of the fourth quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the second quarter of 2018. By comparison, 24 hedge funds held shares or bullish call options in WUBA a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Platinum Asset Management was the largest shareholder of 58.com Inc (NYSE:WUBA), with a stake worth $77.8 million reported as of the end of September. Trailing Platinum Asset Management was Lakewood Capital Management, which amassed a stake valued at $72.4 million. GMT Capital, First Pacific Advisors LLC, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Because 58.com Inc (NYSE:WUBA) has experienced declining sentiment from hedge fund managers, it's easy to see that there lies a certain "tier" of money managers that slashed their full holdings last quarter. Interestingly, Lei Zhang's Hillhouse Capital Management sold off the largest stake of all the hedgies watched by Insider Monkey, comprising an estimated $194.2 million in stock, and Philip Hempleman's Ardsley Partners was right behind this move, as the fund cut about $1.1 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 1 funds last quarter.

Let's go over hedge fund activity in other stocks - not necessarily in the same industry as 58.com Inc (NYSE:WUBA) but similarly valued. These stocks are Andeavor Logistics LP (NYSE:ANDX), Athene Holding Ltd. (NYSE:ATH), MarketAxess Holdings Inc. (NASDAQ:MKTX), and Interpublic Group of Companies Inc (NYSE:IPG). This group of stocks' market values resemble WUBA's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position ANDX,6,7867,0 ATH,43,1280178,1 MKTX,17,202565,4 IPG,29,722472,13 Average,23.75,553271,4.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $553 million. That figure was $432 million in WUBA's case. Athene Holding Ltd. (NYSE:ATH) is the most popular stock in this table. On the other hand Andeavor Logistics LP (NYSE:ANDX) is the least popular one with only 6 bullish hedge fund positions. 58.com Inc (NYSE:WUBA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. A handful of hedge funds were also right about betting on WUBA as the stock returned 31.1% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index