Did Hedge Funds Drop The Ball On Arena Pharmaceuticals, Inc. (ARNA)

The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Arena Pharmaceuticals, Inc. (NASDAQ:ARNA).

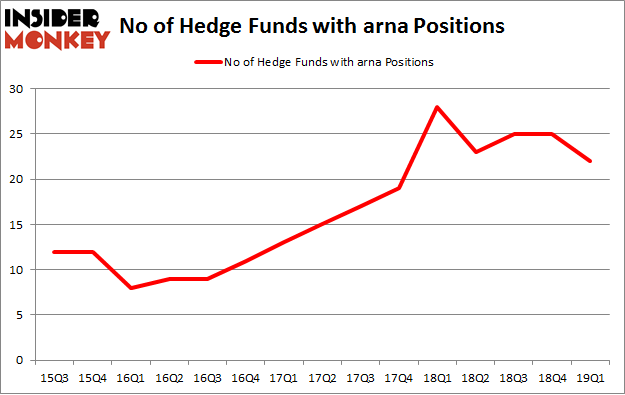

Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) investors should pay attention to a decrease in enthusiasm from smart money in recent months. Our calculations also showed that arna isn't among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a lot of gauges investors can use to grade publicly traded companies. Some of the most useful gauges are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the top money managers can beat their index-focused peers by a solid margin (see the details here).

We're going to take a look at the new hedge fund action regarding Arena Pharmaceuticals, Inc. (NASDAQ:ARNA).

Hedge fund activity in Arena Pharmaceuticals, Inc. (NASDAQ:ARNA)

At Q1's end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ARNA over the last 15 quarters. With hedgies' sentiment swirling, there exists an "upper tier" of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

The largest stake in Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) was held by Partner Fund Management, which reported holding $145.9 million worth of stock at the end of March. It was followed by Perceptive Advisors with a $62.8 million position. Other investors bullish on the company included Rubric Capital Management, Citadel Investment Group, and Alyeska Investment Group.

Due to the fact that Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) has faced bearish sentiment from the smart money, it's easy to see that there were a few fund managers that elected to cut their entire stakes last quarter. Interestingly, Stephen DuBois's Camber Capital Management dumped the biggest stake of the 700 funds followed by Insider Monkey, comprising about $19.5 million in stock, and Steve Cohen's Point72 Asset Management was right behind this move, as the fund said goodbye to about $10.7 million worth. These moves are interesting, as aggregate hedge fund interest fell by 3 funds last quarter.

Let's now review hedge fund activity in other stocks similar to Arena Pharmaceuticals, Inc. (NASDAQ:ARNA). We will take a look at Denali Therapeutics Inc. (NASDAQ:DNLI), Nelnet, Inc. (NYSE:NNI), Appian Corporation (NASDAQ:APPN), and Shenandoah Telecommunications Company (NASDAQ:SHEN). This group of stocks' market caps are closest to ARNA's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position DNLI,10,7646,5 NNI,15,77013,1 APPN,19,331791,10 SHEN,14,100597,3 Average,14.5,129262,4.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $129 million. That figure was $384 million in ARNA's case. Appian Corporation (NASDAQ:APPN) is the most popular stock in this table. On the other hand Denali Therapeutics Inc. (NASDAQ:DNLI) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ARNA as the stock returned 19.4% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index