Did You Manage To Avoid FAT Brands's (NASDAQ:FAT) 35% Share Price Drop?

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the FAT Brands Inc. (NASDAQ:FAT) share price slid 35% over twelve months. That's well bellow the market return of 5.1%. We wouldn't rush to judgement on FAT Brands because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 24% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for FAT Brands

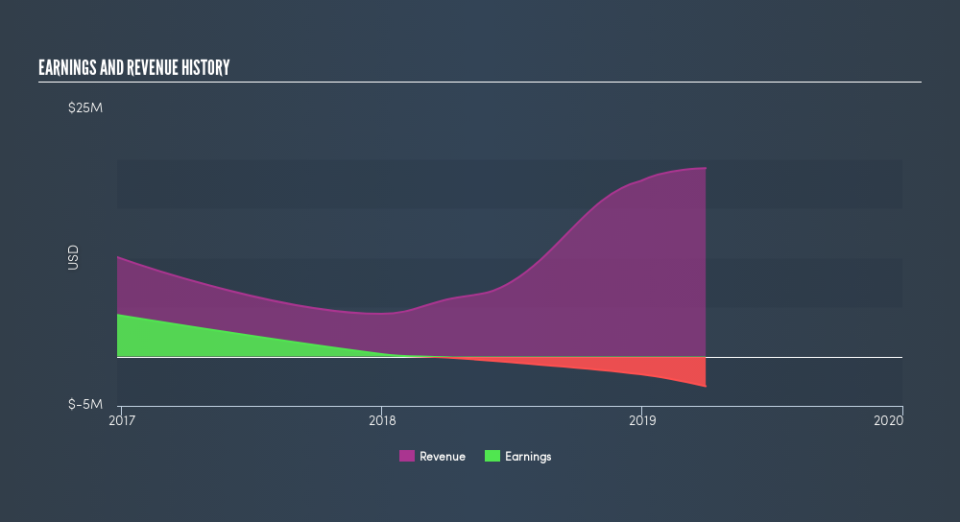

Because FAT Brands is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year FAT Brands saw its revenue grow by 232%. That's well above most other pre-profit companies. The share price drop of 35% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of FAT Brands, it has a TSR of -31% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Given that the market gained 5.1% in the last year, FAT Brands shareholders might be miffed that they lost 31% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 24% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

FAT Brands is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.