Did You Manage To Avoid Identiv's (NASDAQ:INVE) Devastating 73% Share Price Drop?

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Imagine if you held Identiv, Inc. (NASDAQ:INVE) for half a decade as the share price tanked 73%. And some of the more recent buyers are probably worried, too, with the stock falling 46% in the last year. The falls have accelerated recently, with the share price down 57% in the last three months.

See our latest analysis for Identiv

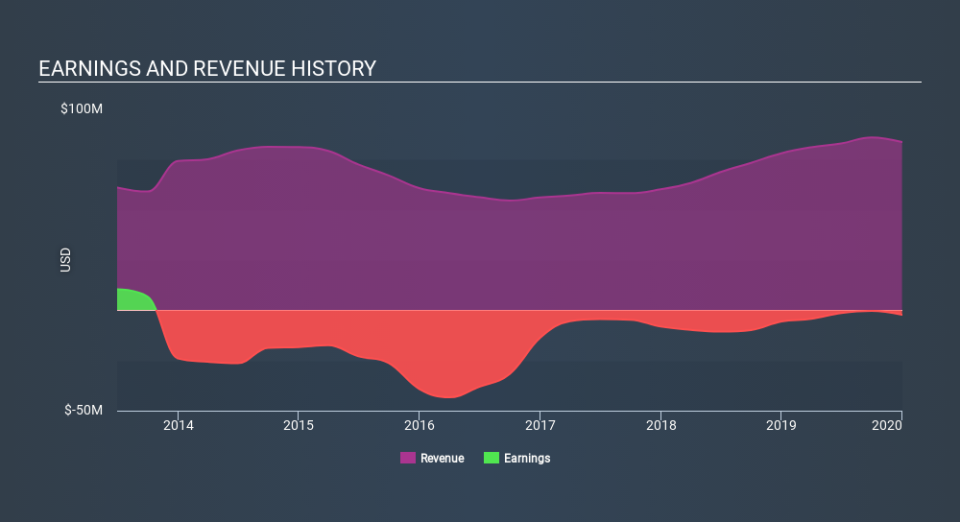

Given that Identiv didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Identiv saw its revenue increase by 4.0% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 23% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Identiv in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that Identiv shareholders are down 46% for the year. Unfortunately, that's worse than the broader market decline of 4.9%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 23% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Identiv better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Identiv you should know about.

Identiv is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.