Did You Miss Atlantic Capital Bancshares's (NASDAQ:ACBI) 20% Share Price Gain?

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to buy stocks, some of them will be below average performers. Unfortunately for shareholders, while the Atlantic Capital Bancshares, Inc. (NASDAQ:ACBI) share price is up 20% in the last year, that falls short of the market return. Zooming out, the stock is actually down 0.6% in the last three years.

See our latest analysis for Atlantic Capital Bancshares

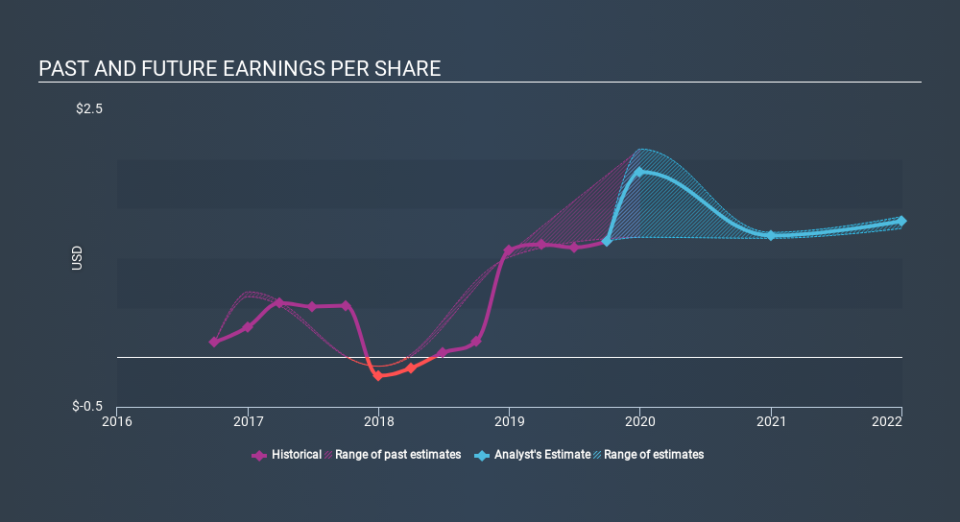

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Atlantic Capital Bancshares saw its earnings per share (EPS) increase strongly. This remarkable growth rate may not be sustainable, but it is still impressive. We are not surprised the share price is up. We're real advocates of letting inflection points like this guide our research as stock pickers.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Atlantic Capital Bancshares has grown profits over the years, but the future is more important for shareholders. This free interactive report on Atlantic Capital Bancshares's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Over the last year Atlantic Capital Bancshares shareholders have received a TSR of 20%. Unfortunately this falls short of the market return of around 36%. On the bright side, that's certainly better than the yearly loss of about 0.2% endured over the last three years, implying that the company is doing better recently. It could well be that the business is stabilizing. Before spending more time on Atlantic Capital Bancshares it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.