Did You Miss Aurora Cannabis's (TSE:ACB) Magnificent 2364% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the Aurora Cannabis Inc. (TSE:ACB) share price, which skyrocketed 2364% over three years. Also pleasing for shareholders was the 16% gain in the last three months.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Aurora Cannabis

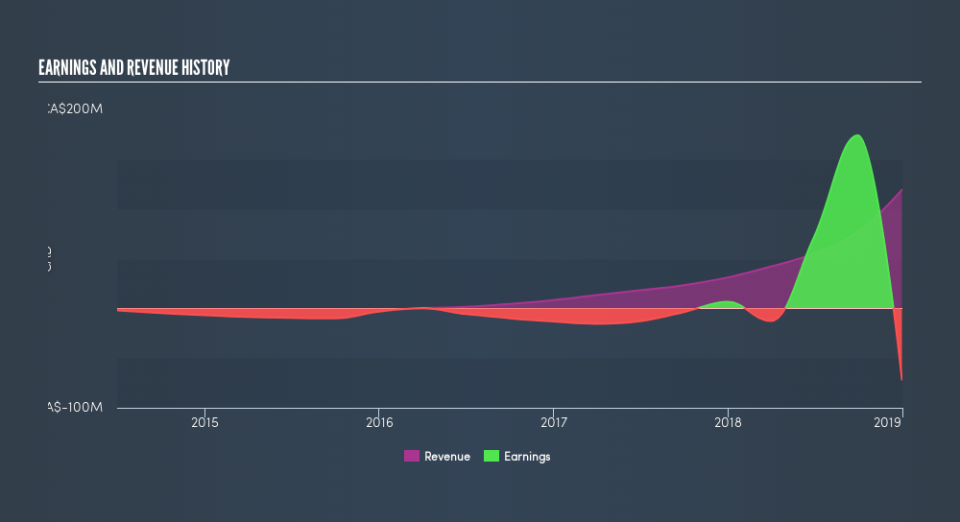

Given that Aurora Cannabis didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years Aurora Cannabis has grown its revenue at 110% annually. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 191% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Aurora Cannabis can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We've already covered Aurora Cannabis's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Aurora Cannabis hasn't been paying dividends, but its TSR of 2457% exceeds its share price return of 2364%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Aurora Cannabis shareholders have gained 51% (in total) over the last year. That falls short of the 195% it has made, for shareholders, each year, over three years. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.