Did You Miss Covetrus' (NASDAQ:CVET) Impressive 188% Share Price Gain?

The Covetrus, Inc. (NASDAQ:CVET) share price has had a bad week, falling 12%. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Like an eagle, the share price soared 188% in that time. So it may be that the share price is simply cooling off after a strong rise. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

See our latest analysis for Covetrus

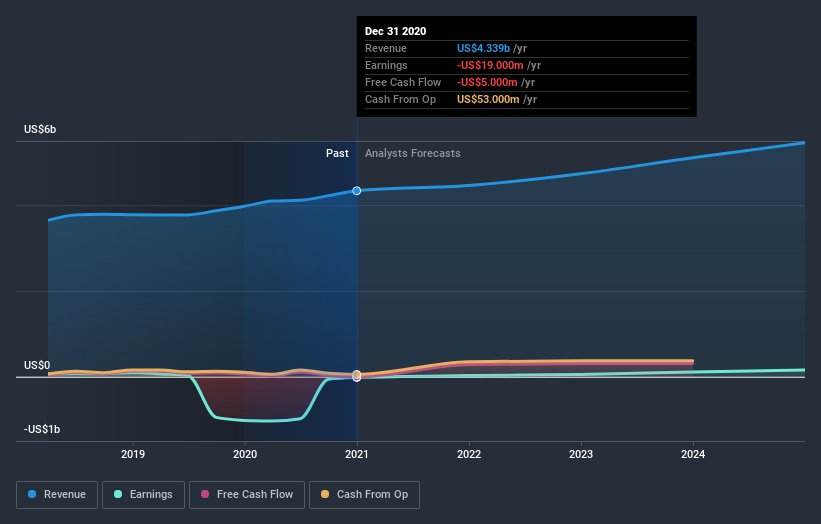

Covetrus isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Covetrus' revenue grew by 9.1%. That's not great considering the company is losing money. In contrast, the share price took off during the year, gaining 188%. The business will need a lot more growth to justify that increase. We're not so sure that revenue growth is driving the market optimism about the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Covetrus boasts a total shareholder return of 188% for the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 20%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). It's always interesting to track share price performance over the longer term. But to understand Covetrus better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Covetrus you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.