Did You Miss Ooma's (NYSE:OOMA) 81% Share Price Gain?

While Ooma, Inc. (NYSE:OOMA) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 23% in the last quarter. But over three years, the returns would have left most investors smiling To wit, the share price did better than an index fund, climbing 81% during that period.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Ooma

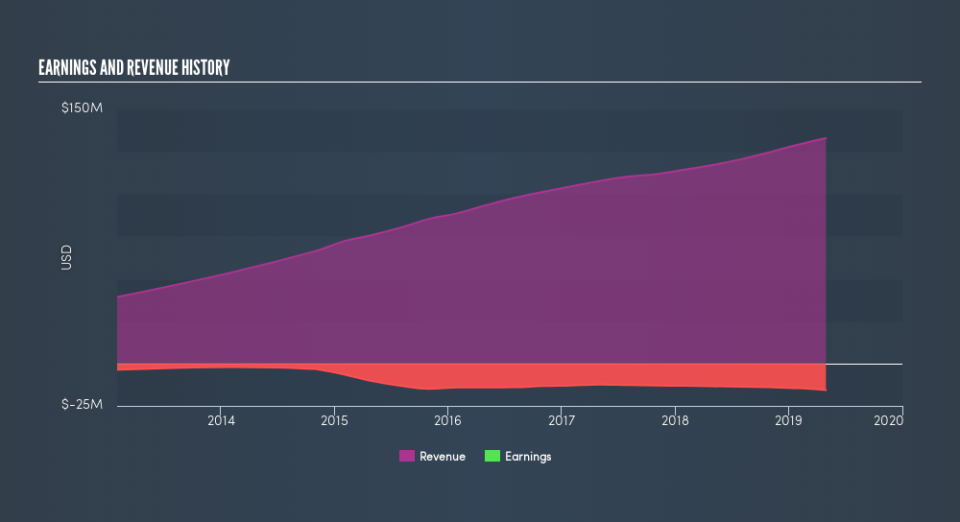

Ooma isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years Ooma has grown its revenue at 11% annually. That's a very respectable growth rate. The share price gain of 22% per year shows that the market is paying attention to this growth. If that's the case, then it could be well worth while to research the growth trajectory. Of course, it's always worth considering funding risks when a company isn't profitable.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on Ooma's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Ooma's total shareholder return last year was 5.6%. The TSR has been even better over three years, coming in at 22% per year. Before spending more time on Ooma it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.