Dillard's (DDS) Rises as Q2 Earnings & Sales Beat Estimates

Dillard's Inc. DDS reported second-quarter fiscal 2021 results, wherein the bottom and top lines surpassed the Zacks Consensus Estimate and advanced year over year. Results gained from continued momentum in consumer demand throughout the fiscal second quarter. This along with the continued focus on inventory management and expense control led to sequential growth in the quarter.

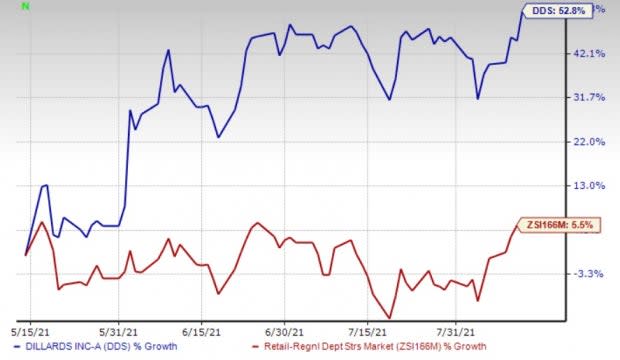

Shares of Dillard’s gained 5.1% on Aug 12, following strong second-quarter fiscal 2021 results. In the past three months, shares of this Zacks Rank #3 (Hold) company have advanced 52.8% compared with the industry’s growth of 5.5%.

Image Source: Zacks Investment Research

Q2 Details

Dillard's adjusted earnings of $8.81 per share surpassed the Zacks Consensus Estimate of $2.45. The bottom line compared favorably with the year-ago quarter’s loss of 37 cents per share. The uptick can be attributable to robust sales, improved margins and lower expenses.

Net sales of $1,570.4 million surged 70.9% from the prior-year quarter and beat the Zacks Consensus Estimate of $1,258 million. Total retail sales (excluding CDI Contractors, LLC) skyrocketed 72.3% year over year to $1,539.4 million. Total retail sales increased 12% from the second quarter of fiscal 2019. Solid performance in ladies’ apparel and shoes contributed to quarterly growth. Comparable store sales increased 14% from the second quarter of fiscal 2019.

Retail gross margin improved significantly to 41.7% from 31.1% in the year-ago quarter and rose 1,299 basis points (bps) from 28.7% in the second quarter of fiscal 2019. The increase can be attributed to improved consumer demand and better inventory management, which led to lower markdowns in the fiscal second quarter. On a consolidated basis, gross margin of 41% reflects a sharp improvement from 30.4% in the prior-year quarter.

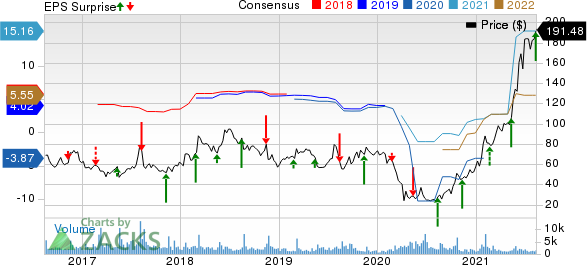

Dillards, Inc. Price, Consensus and EPS Surprise

Dillards, Inc. price-consensus-eps-surprise-chart | Dillards, Inc. Quote

Dillard's consolidated SG&A expenses (as a percentage of sales) contracted 580 bps to 23.3% from the prior-year quarter’s 29.1%. In dollar terms, SG&A expenses (operating expenses) grew roughly 37% to $365.9 million. The decline was driven by lower payroll and payroll-related expenses as the company operates with reduced operating hours and fewer associates. The retail operating expense rate declined 591 bps to 23.7%. In dollar terms, operating expenses fell 10.6% year over year to $364.2 million.

Financial Details & Liquidity

Dillard’s ended the quarter with cash and cash equivalents of $669.5 million, long-term debt and finance leases of $365.9 million, and total shareholders’ equity of $1,609.6 million.

In the six months ended Jul 31, 2021, the company generated $492.4 million of cash from operating activities. It bought back 0.7 million shares worth $112.2 million in the fiscal second quarter, under its $500-million repurchase program announced in March 2018. As of Jul 31, it had $2.1 million authorization left under the aforementioned program.

3 Better-Ranked Stocks to Consider

Kohl’s Corporation KSS has an impressive long-term earnings growth rate of 8% and it sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Macy’s, Inc. M currently flaunts a Zacks Rank #1 and it has a long-term earnings growth rate of 12%.

Hibbett, Inc. HIBB has a long-term earnings growth rate of 17.7% and it sports a Zacks Rank #1 at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macys, Inc. (M) : Free Stock Analysis Report

Kohls Corporation (KSS) : Free Stock Analysis Report

Dillards, Inc. (DDS) : Free Stock Analysis Report

Hibbett, Inc. (HIBB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research