Dine Brands (DIN) Stock Down on Q4 Earnings & Revenues Miss

Dine Brands Global, Inc. DIN reported fourth-quarter 2020 results, wherein both earnings and revenues missed the Zacks Consensus Estimate. Both the metrics also declined sharply year over year. Following the results, the company’s shares declined 3.3% on Mar 2.

Adjusted earnings were 39 cents per share, which lagged the consensus mark of 59 cents. In the prior-year quarter, the company reported earnings per share of $1.78. Dismal customer traffic due to the coronavirus pandemic impacted the company’s fourth-quarter results.

Total revenues in the reported quarter were $196 million, down 13.8% on a year-over-year basis. Moreover, the top line missed the consensus estimate of $197 million. Dismal royalties, franchise fees and other; and advertising revenues hurt the company’s revenues.

Brand Performances by Comps

Applebee's domestic system-wide comps declined 17.6%. This compares unfavorably with the prior-year quarter’s decline of 2.5%.

IHOP’s domestic system-wide comps were down 30.1%, against the prior-year quarter’s growth of 1.1%.

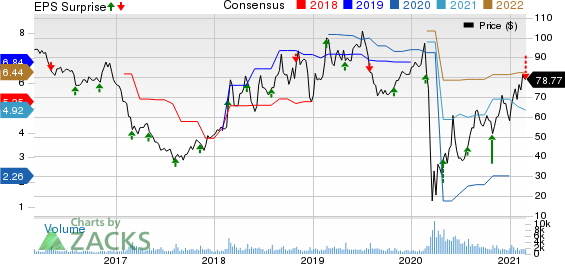

DINE BRANDS GLOBAL, INC. Price, Consensus and EPS Surprise

DINE BRANDS GLOBAL, INC. price-consensus-eps-surprise-chart | DINE BRANDS GLOBAL, INC. Quote

Costs & Gross Profits

In the fourth quarter, the total cost of revenues decreased 5.4% year over year to $39.4 million. Moreover, gross profits were $67.4 million, down 29.6% from the year-ago quarter.

General and administrative expenses in the quarter decreased 3.7% year over year to $38.8 million.

Balance Sheet

As of Dec 31, 2020, cash and cash equivalents amounted to $383.4 million compared with $116 million as of Dec 31, 2019. Long-term debt at the end of fourth-quarter 2020 totaled $1,492 million compared with $1,288.2 million at the end of 2019. Goodwill as of Dec 31, 2020, was $251.6 million.

Cash flow from operating activities totaled $96.5 million as of Dec 31, 2020, compared with $155.2 million as of Dec 31, 2019.

2021 View

The company anticipates the coronavirus pandemic to continue hurting its performance in 2021. Due to the uncertainty surrounding the pandemic, the company refrained from providing the full business outlook for 2021.

The company anticipates general and administrative expenses for 2021 in the range of nearly $160 million to $170 million. The company expects capital expenditure to be nearly $14 million, which includes $5 million related to its restaurants segment.

Zacks Rank & Peer Releases

The company currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Yum! Brands, Inc. YUM reported strong fourth-quarter 2020 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Both the metrics improved year over year. The company’s adjusted earnings of $1.15 beat the Zacks Consensus Estimate of 99 cents. In the prior-year quarter, the company had reported adjusted earnings of $1.00. Quarterly revenues of $1,743 million surpassed the consensus estimate of $1,731 million. The top line also increased 3% year over year. The upside can be attributed to increase in company sales.

McDonald's Corporation MCD reported fourth-quarter 2020 results, wherein both earnings and revenues missed the Zacks Consensus Estimate. The company reported adjusted earnings of $1.70 per share, which lagged the Zacks Consensus Estimate of $1.75. Moreover, the bottom line declined 14% year over year. Quarterly revenues of $5,313.8 million missed the Zacks Consensus Estimate of $5,320 million. The top line declined 2% year over year. The downside can be attributed to the coronavirus pandemic.

Starbucks Corporation SBUX reported mixed first-quarter fiscal 2021 results, wherein earnings beat the Zacks Consensus Estimate but revenues missed the same. The company reported adjusted earnings per share (EPS) of 61 cents, which outpaced the Zacks Consensus Estimate of 55 cents. In the prior-year quarter, the company had reported adjusted EPS of 79 cents. Meanwhile, quarterly revenues of $6,749.4 million missed the Zacks Consensus Estimate of $6,873 million. Moreover, the top line fell 4.9% from the year-ago quarter’s levels. The downside was due to dismal global retail and comparable sales, and decline in store traffic.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research