Discover Financial (DFS) Q4 Earnings Beat on New Account Growth

Discover Financial Services DFS reported fourth-quarter 2021 adjusted earnings of $3.64 per share, which outpaced the Zacks Consensus Estimate of $3.61. The bottom line also improved 41% year over year.

Based in Riverwoods, IL, DFS’ revenues — net of interest expenses — inched up 4% year over year to $2,936 million. Yet, the top line missed the Zacks Consensus Estimate of $2,997 million.

The strong fourth-quarter earnings were supported by a solid performance of the Digital Banking business. Increased sales, new account growth and strong credit performance were major positives. Yet, the positives were partially offset by escalating operating costs.

DFS’ integrated digital banking and payments model as well as ongoing economic recovery buoyed the company’s results. Its new account growth in 2021 and resultant contribution to loan growth will likely drive 2022 results. The company expects loan growth for 2022 in high-single digits. Net interest margin for 2022 is expected to be relatively in line with the 2021 figure. Yet, total operating expenses are likely to rise in mid-single digits, which might put pressure on the bottom line. The average net charge-off rate for 2022 is expected within 2.2-2.6%, indicating an increase from 1.8% in 2021.

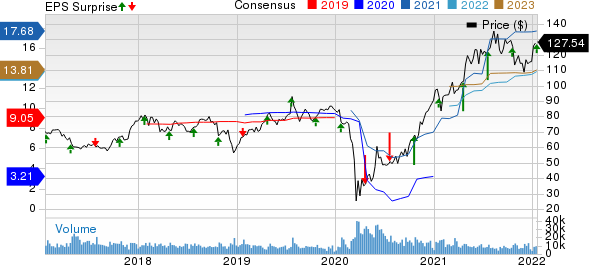

Discover Financial Services Price, Consensus and EPS Surprise

Discover Financial Services price-consensus-eps-surprise-chart | Discover Financial Services Quote

Q4 Operational Update

Operating efficiency declined to 44.7% for fourth-quarter 2021 from 45.2% in the year-ago period.

Interest expenses plunged to $259 million for the quarter under review from $383 million a year ago.

Total operating expenses escalated to $1,312 million from $1,278 million a year ago due to a rise in costs related to marketing, and business development and professional fees.

Net income increased to $1,067 million for the December quarter from $799 million a year ago.

Q4 Segmental Update

Digital Banking Segment

The segment’s pre-tax income of $1,458 billion surged 47% from $991 million a year ago. The improvement can be attributed to reduced provision for credit losses and increased revenues, net of interest expense. Yet, the same was partly offset by 3% elevated operating costs.

Total loans inched up 4% year over year to $93,684 million at fourth quarter-end. Likewise, credit card loans increased 4% year over year to $74,369 million. While personal loans fell 3% year over year, private student loans grew 2% year over year.

Net interest income advanced 4% year over year to $2,483 million, courtesy of favorable funding costs, increased average receivables and reduced interest charge-offs.

Net interest margin improved 18 basis points year over year to 10.8% for the quarter under review.

Payment Services Segment

The segment reported a pre-tax loss of $97 million against the prior-year quarter’s income of $24 million. An unrealized loss on equity investments affected the segment.

Payment Services volume expanded 19% year over year to $83,387million for the fourth quarter.

PULSE dollar volume rose 18% year over year on the back of expansion of all debit products resulting from economic recovery, in turn leading to improved spending. Diners Club volume improved 17% year over year, following revival from COVID-induced adversities. Network Partners volume climbed 29% year over year, attributable to improved AribaPay volume.

Financial Position (as of Dec 31, 2021)

Discover Financial exited the fourth quarter with total assets of $110,242 million, which declined 2% year over year. The liquidity portfolio (comprising cash and cash equivalents and other investments but excluding cash-in-process) of $14,959 million at fourth quarter-end declined 39% year over year.

Total liabilities were $96,834 million, reflecting a decline of 5% year over year.

Meanwhile, total equity increased 23% year over year to $13,408 million.

Share Repurchase and Dividend

In the December quarter, the company bought back shares worth $773 million. Shares of common stock outstanding dipped 2.2% sequentially.

For the fourth quarter, DFS declared a dividend of 50 cents per share, in line with the previous quarter. It will be paid out on Mar 3, 2022 to shareholders of record on Feb 17, 2022.

Zacks Rank & Key Picks

Discover Financial carries a Zacks Rank #3 (Hold). Some better-ranked players in the Finance sector include Ryan Specialty Group Holdings, Inc. RYAN, Houlihan Lokey, Inc. HLI, and Brown & Brown, Inc. BRO, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based in Chicago, IL, Ryan Specialty provides numerous specialty products and solutions for insurance brokers, agents, and others. It acts as a wholesale broker and managing underwriter to provide risk management services. Ryan Specialty’s bottom line for the next year is expected to jump 13.6% year over year to $1.22 per share. RYAN has witnessed one upward estimate revision in the past 30 days and no movement in the opposite direction.

Houlihan Lokey — headquartered in Los Angeles, CA — provides multiple financial services to clients all over the world. Its growing footprint in Europe and Asia’s investment banking services field will help HLI boost strategic and shareholder value in the coming days. Rising average transaction fees will help HLI increase corporate finance revenues. The bottom line of Houlihan Lokey for the current year is expected to rise 44.8% year over year to $6.69 per share.

Headquartered in Daytona Beach, FL, Brown & Brown boasts an impressive growth potential driven by organic means and a prudent inorganic story. Its strategic efforts continue to drive commission and fees, and sturdy performance is boosting cash flows. Brown & Brown’s 2022 earnings per share are expected to rise 5.9% year over year to $2.29. It has witnessed three upward estimate revisions in the past 30 days versus none in the opposite direction.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

Ryan Specialty Group Holdings, Inc. (RYAN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research