Discovery (DISCA) Q2 Earnings Top Estimates, Revenues Rise Y/Y

Discovery DISCA reported second-quarter 2021 adjusted earnings of $1.01 per share, which beat the Zacks Consensus Estimate by 83.6% and increased 152.5% year over year.

Revenues increased 20.5% year over year to $3.06 billion and beat the consensus mark by 3.1%.

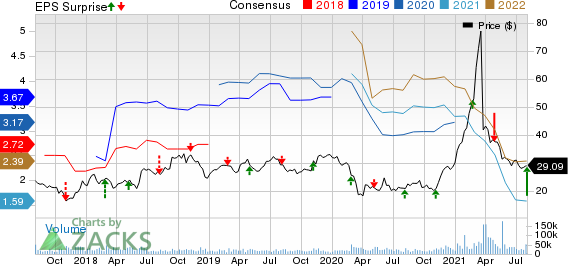

Discovery, Inc. Price, Consensus and EPS Surprise

Discovery, Inc. price-consensus-eps-surprise-chart | Discovery, Inc. Quote

Top-Line Details

Advertising revenues climbed 28.6% year over year to $1.63 billion. Moreover, Distribution revenues increased 11.7% year over year to $1.36 billion. Other revenues were $57 million, up 32.6% from the year-ago quarter.

U.S. Networks (64.4% of revenues) revenues increased 12.4% on a year-over-year basis to $1.97 billion. Advertising revenues increased 12.2%. Distribution revenues grew 12% primarily driven by the launch of discovery+ in January 2021 and increases in contractual affiliate rates.

Subscribers of Discovery’s fully distributed networks were 3% lower on a year-over-year basis. Total portfolio subscribers declined 7% year over year.

International Networks revenues (35.7% of revenues) increased 36.9% year over year to $1.09 billion. Advertising revenues were up 87.7% while distribution revenues increased 11.1%.

Discovery ended the second quarter with 17 million paying direct-to-consumer subscribers. For the second quarter, Discovery was the #1 most-watched pay-TV portfolio in the U.S. among key demographics and the #1 portfolio in all of television for average time spent viewing among women aged 25-54.

Additionally, HGTV and ID were the #1 and #2 cable networks respectively among women aged 25-54 in Total Day during the second quarter.

Operating Details

In the second quarter, selling, general and administrative (SG&A) expenses surged 49.9% from the year-ago quarter to $952 million.

Adjusted operating income before depreciation & amortization (“OIBDA”) decreased 0.9% from the year-ago quarter to $1.1 billion.

U.S. Networks adjusted OIBDA decreased 1.1% from the year-ago quarter to $1.05 billion. International Networks’ adjusted OIBDA increased 11.4% from the year-ago quarter to $215 million.

GAAP operating income increased 8.6% year over year to $779 million.

Balance Sheet

As of Jun 30, 2021, cash & cash equivalents were $2.8 billion compared with $2 billion as of Mar 31, 2021.

Zacks Rank & Stocks to Consider

Currently, Discovery carries a Zacks Rank #3 (Hold).

Entravision Communications Corporation EVC, Penn National Gaming, Inc. PENN and PlayAGS, Inc. AGS are some better-ranked stocks in the broader consumer & discretionary sector, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Entravision Communications, Penn Gaming and PlayAGS are each set to report quarterly results on Aug 5.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discovery, Inc. (DISCA) : Free Stock Analysis Report

Penn National Gaming, Inc. (PENN) : Free Stock Analysis Report

Entravision Communications Corporation (EVC) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research