You Should Diversify With These Industrial Dividend Stocks

The industrials sector tends to be highly cyclical, impacting companies operating in an array of areas such as building products, aerospace and defence. As such, the position a company has relative to the economic cycle drives its level of profitability. This impacts cash flows which in turn determines the level of dividend payout. During times of growth, these industrial names could provide a strong boost to your portfolio income. If you’re a buy-and-hold investor, these healthy dividend stocks in the industrials industry can generously contribute to your monthly portfolio income.

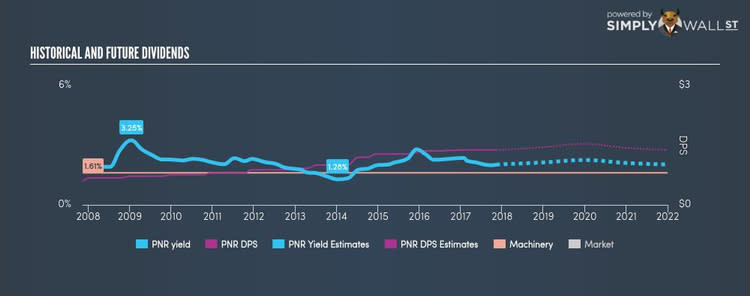

Pentair plc (NYSE:PNR)

PNR has a nice dividend yield of 2.02% and their payout ratio stands at 64.79% . The company’s dividends per share have risen from $0.6 to $1.38 since it started paying dividends 10 years ago. The company has been a reliable payer too, not missing a payment during this time. The company also looks promising for it’s future growth, with analysts expecting an earnings per share increase of 93.48% over the next three years.

W.W. Grainger, Inc. (NYSE:GWW)

GWW has a solid dividend yield of 2.52% and has a payout ratio of 59.33% . GWW’s dividends have seen an increase since they started paying dividends 10 years ago, with payments increasing from $1.4 to $5.12 in that time. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. The company’s future earnings growth looks promising, with analysts expecting earnings growth over the next three years to reach 60.94%.

Icahn Enterprises L.P. (NASDAQ:IEP)

IEP has an alluring dividend yield of 10.82% and pays out 68.82% of its profit as dividends . Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from $0.58 to $6. Comparing Icahn Enterprises’s PE ratio against the US Industrial Conglomerates industry draws favorable results, with the company’s PE of 6.4 being below that of its industry (26.4).

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.