You Should Diversify With These Materials Dividend Stocks

A favourable economic condition has been a large driver of growth for companies in the materials industry. Therefore, this industry is a macroeconomic play with the opportunity of riding the wave in times of robust demand for commodities. Commodity prices are also a key determinant of these companies’ earnings, which in turn drives dividend payout and yield. I’ve made a list of other value-adding dividend-paying stocks in the materials industry for you to consider for your investment portfolio.

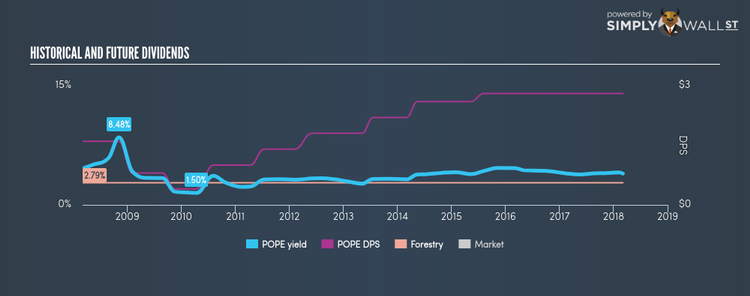

Pope Resources, A Delaware Limited Partnership (NASDAQ:POPE)

POPE has a nice dividend yield of 3.94% and has a payout ratio of 67.66% . Despite there being some hiccups, dividends per share have increased during the past 10 years. Pope Resources A Delaware Limited Partnership’s earnings growth over the past 12 months has exceeded the us forestry industry, with the company reporting an EPS growth of 207.93% while the industry totaled 10.71%. Continue research on Pope Resources A Delaware Limited Partnership here.

Tredegar Corporation (NYSE:TG)

TG has a sizeable dividend yield of 2.79% and is paying out 37.90% of profits as dividends . In the case of TG, they have increased their dividend per share from US$0.16 to US$0.44 so in the past 10 years. It should comfort existing and potential future shareholders to know that TG hasn’t missed a payment during this time. Tredegar’s performance over the last 12 months beat the us chemicals industry, with the company reporting 56.34% EPS growth compared to its industry’s figure of 16.03%. More on Tredegar here.

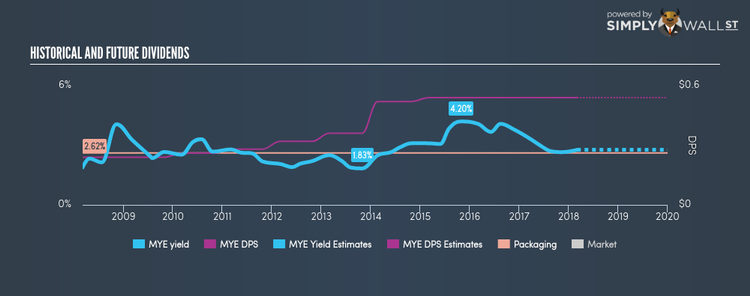

Myers Industries, Inc. (NYSE:MYE)

MYE has a nice dividend yield of 2.77% with a generous payout ratio . MYE’s DPS have risen to US$0.54 from US$0.24 over a 10 year period. The company has been a dependable payer too, not missing a payment in this 10 year period. The company also looks promising for it’s future growth, with analysts expecting an impressive doubling of earnings per share over the next year. Interested in Myers Industries? Find out more here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.