You Should Diversify With These Tech Dividend Stocks

ADTRAN, Meredith, and AVX are technology companies which share a common feature – they’re also great dividend stocks. The tech sector is known to be highly volatile and cyclical since firms face high competition and constant disruption. Though, companies that are able to build a strong moat are incredibly profitable and some payout high dividends as a result. As a long term investor, I favour these tech stocks with great dividend payments that continues to add value to my portfolio.

ADTRAN, Inc. (NASDAQ:ADTN)

ADTN has a good-sized dividend yield of 2.25% and distributes 72.71% of its earnings to shareholders as dividends . Even though dividends per share have dropped over the last 10, I’d argue that this is tolerable given the fact that they haven’t missed a payment in this time, and dividend hunters are after reliability. Analysts are enthusiastic about the company’s future growth, estimating a 83.72% earnings per share increase in the next three years. Continue research on ADTRAN here.

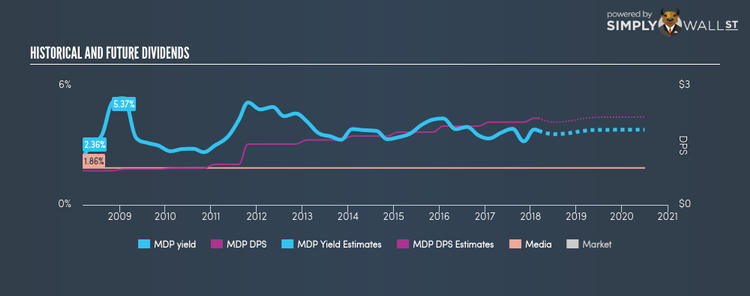

Meredith Corporation (NYSE:MDP)

MDP has a wholesome dividend yield of 3.73% and their current payout ratio is 33.74% . MDP’s dividends have seen an increase over the past 10 years, with payments increasing from US$0.86 to US$2.18 in that time. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. More detail on Meredith here.

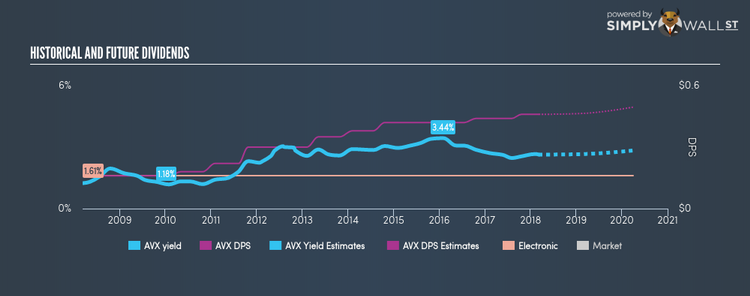

AVX Corporation (NYSE:AVX)

AVX has a decent dividend yield of 2.64% with a large payout ratio . AVX has increased its dividend from US$0.16 to US$0.46 over the past 10 years. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. AVX could be a good investment for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next 12 months Dig deeper into AVX here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.