DocuSign (DOCU) Shares Barely Move Despite Q4 Earnings Beat

DocuSign, Inc.’s DOCU fourth-quarter fiscal 2023 (ended Jan 31) presented better-than-expected results with both earnings and revenues showing year-over-year growth, but failed to impress the market. The stock has not seen any movement after the result release (Mar 9, after market close).

Non-GAAP earnings per share (excluding 62 cents from non-recurring items) of 65 cents beat the consensus mark by 22.6% and grew 35.4% from the year-ago fiscal quarter’s reported figure. Revenues of $659.6 million also surpassed the Zacks Consensus Estimate by 3.2% and increased 13.6% from the year-ago fiscal quarter’s reported figure.

Shares of DOCU have dropped 32.2% in the past year compared with its industry’s 21.5% decrease.

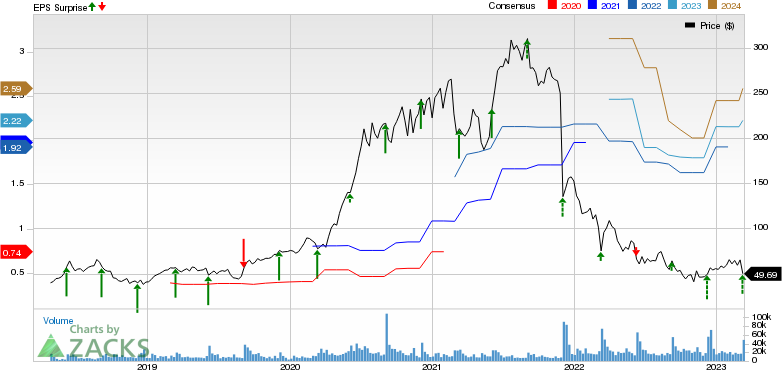

DocuSign Price, Consensus and EPS Surprise

DocuSign price-consensus-eps-surprise-chart | DocuSign Quote

Quarter in Details

Subscription revenues came in at $643.7 million, up 14.1% year over year. Professional services and other revenues decreased 5.4% from the year-ago fiscal quarter’s reported figure to $15.9 million. For the reported quarter, International revenues increased 19.6% from the year-ago fiscal quarter’s reported figure to $165 million. Billings of $739 million were up 10.3% from the year-ago fiscal quarter’s reported figure.

Non-GAAP gross margin was at 83% compared with 81% in the same period last year. Non-GAAP gross profit of $522.2 million increased 16.2% year over year. Non-GAAP operating margin of 24% increased 600 basis points from the year-ago figure.

Balance Sheet & Cash Flow

DocuSign ended the quarter with cash and cash equivalents of $721.9 million compared with $632.6 million at the end of the previous quarter. It generated $137.1 million in cash from operating activities and a capex of $24.1 million. Non-GAAP free cash flow was $113 million.

First Quarter Fiscal 2024 Guidance

The company expects the revenue to be in the range of $639-$643 million. The Zacks Consensus Estimate for the revenue is pegged at $642.6 million, which is above the midpoint ($641 million) of the guided range. In segmental revenues, subscription revenues are expected to be in the $625-$629 band. Non-GAAP gross margin and non-GAAP operating margin are expected to be 81-82% and 21-22% respectively.

Fiscal 2024 Guidance

The company expects the revenue to be in the range of $2.69-$2.7 billion. The Zacks Consensus mark for the revenue is pegged at $2.69 million. In segmental revenues, subscription revenues are expected to be in the $2.63-$2.65 billion band. Non-GAAP gross margin and non-GAAP operating margin are expected to be 81-82% and 21-23% respectively.

Currently, DocuSign carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The following stocks from the Business Service sector reported better-than-expected fourth-quarter results.

Gartner, Inc. IT, carrying a Zacks Rank of 2, reported better-than-expected fourth-quarter 2022 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings (excluding 49 cents from non-recurring items) per share of $3.70 beat the Zacks Consensus Estimate by 44% and increased 23.8% year over year. IT’s revenues of $1.5 billion beat the Zacks Consensus Estimate by 2.6% and improved 15.2% year over year on a reported basis and 20% on a foreign-currency-neutral basis.

Aptiv PLC (APTV), carrying Zacks Rank #3 (Hold), reported better-than-expected fourth-quarter 2022 results. Adjusted earnings (excluding 41 cents from non-recurring items) of $1.27 per share beat the Zacks Consensus Estimate by 6.7% and increased more than 100% on a year-over-year basis. APTV’s revenue surpassed the Zacks Consensus Estimate by 6% and increased 12.2% year over year.

EquifaxEFX, currently holding a Zacks Rank of 3, reported stellar fourth-quarter 2022 results. The company’s earnings and revenues surpassed the Zacks Consensus Estimate. EFX’s adjusted earnings of $1.52 per share beat the Zacks Consensus Estimate by 2.7% but decreased 17.4% on a year-over-year basis. Revenues of $1.2 billion beat the Zacks Consensus Estimate by 1.5% but decreased 4.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report