DocuSign, Inc. (NASDAQ:DOCU) is a Ways off From Profitability, but already has Positive Cash Flows

This article has been originally published on Simply Wall St News

When looking at DocuSign, Inc. ( NASDAQ:DOCU ), investors want to know what are the next major milestones for the company. For new companies, becoming self-sufficient signals a large reduction of bankruptcy risk, as well as that the company is creating a valuable service.

DocuSign, Inc. provides cloud based software in the United States and internationally, where users can digitally sign contracts at greatly reduced cost versus traditional approaches.The US$56b market-cap company posted a loss in its most recent financial year of US$243m and the latest trailing-twelve-month loss of US$165m shrinking the gap between loss and breakeven.

We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

Check out our latest analysis for DocuSign

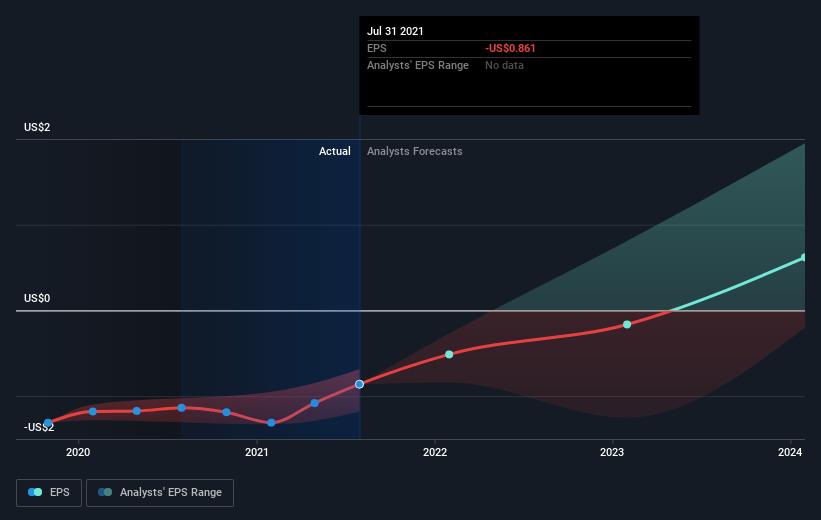

Consensus from 22 of the American Software analysts is that DocuSign is on the verge of breakeven.

They anticipate the company to incur a final loss in 2023, before generating positive profits of US$123m in 2024.So, the company is predicted to breakeven approximately3 years from today.

How fast will the company have to grow each year in order to reach the breakeven point by 2024? Working backwards from analyst estimates, it turns out that they expect the company to grow 102% year-on-year, on average,which is rather optimistic!

Given this is a high-level overview, we won’t go into details of DocuSign's upcoming projects,but,keep in mindthat typicallya high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Looking from a cash flows perspective, we can see that profits are not necessarily telling the full story. Free cash flows have already been positive for a while, which gives us more confidence that profits will converge upwards to cash flows.

One thing we would like to bring into light with DocuSign is itsdebt-to-equity ratio of over 2x.Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity,and the company has considerably exceeded this.Note that a higher debt obligationincreases the risk in investing in the loss-making company.

Offsetting this is the current cash balance of US$822m, which provides a good moat against debt as well as allowing for further capital business investments aimed at delivering growth.

Next Steps:

DocuSign is close to profitability, but has been cash flow positive for a while, which gives investors even more confidence that the company has a viable and growing business model.

This article is not intended to be a comprehensive analysis on DocuSign, so if you are interested in understanding the company at a deeper level, take a look atDocuSign's company page on Simply Wall St . We've also put together a list ofessentialfactorsyou should further examine:

Valuation : What is DocuSign worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether DocuSign is currently mispriced by the market.

Management Team : An experienced management team on the helm increases our confidence in the business – take a look at who sits on DocuSign’s board and the CEO’s background .

Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here .

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com