Dodge & Cox Slashes Stake in Zayo Group

Investment firm Dodge & Cox disclosed earlier this week it reduced its stake in Zayo Group Holdings Inc. (NYSE:ZAYO) by 84.52%.

Founded in 1930, the San Francisco-based firm takes a classic long-term value approach, steering clear of popular companies that trade at premium prices. Rather, it conducts in-depth research into companies trading at low valuations that have strong earnings and cash flow growth prospects.

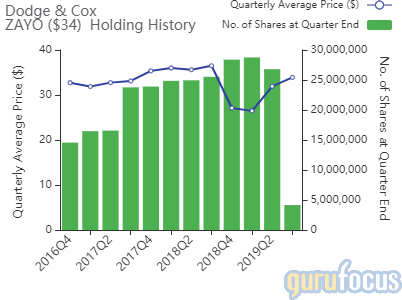

According to GuruFocus Real-Time Picks, a Premium feature, the firm sold 22.6 million shares of the Boulder, Colorado-based company on Sept. 30, bringing its total holding down to 4.15 million shares, which represent 0.11% of the equity portfolio. The stock traded for an average price of $33.90 per share.

GuruFocus estimates the firm has gained nearly 5% on the investment since establishing it in the fourth quarter of 2016.

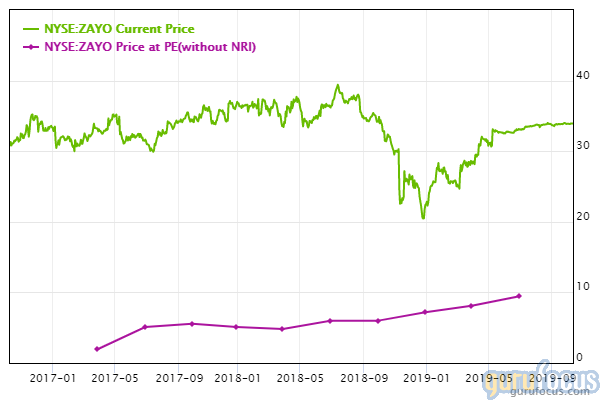

The company, which provides fiber-based communication infrastructure services, has an $8.03 billion market cap; its shares were trading around $34 on Friday with a price-earnings ratio of 53.93, a price-book ratio of 6.06 and a price-sales ratio of 3.17.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced.

In August, Zayo reported its fourth-quarter 2019 financial results. Earnings of 26 cents per share beat Zacks Investment Research's estimates by 11 cents. Revenue declined from the prior-year quarter to $650.6 million, but beat expectations of $647 million.

For the full fiscal year, the company posted earnings of 62 cents per share on $2.6 billion in revenue.

In July, the company also announced its shareholders approved its acquisition deal with affiliates of Digital Colony Partners and the EQT Infrastructure IV Fund. According to the terms of the agreement, Zayo shareholders will receive $35 in cash per share owned. The deal is expected to close in the first half of 2020.

GuruFocus rated Zayo's financial strength 2 out of 10 on the back of a low cash-debt ratio and poor interest coverage. In addition, the Altman Z-Score of 1.01 warns the company could be at risk of going bankrupt since it has recorded a slowdown in revenue growth over the last 12 months.

The company's profitability and growth fared better, scoring a 6 out of 10 rating. In addition to operating margin expansion, Zayo is being supported by returns that outperform over half of its competitors and a moderate Piotroski F-Score of 6, which indicates business conditions are stable.

Despite curbing its position, Dodge & Cox is still the company's largest guru shareholder with 1.76% of outstanding shares. Other gurus who will benefit from the acquisition include Jeremy Grantham (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Alan Fournier (Trades, Portfolio), George Soros (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), John Paulson (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).

Portfolio composition and performance

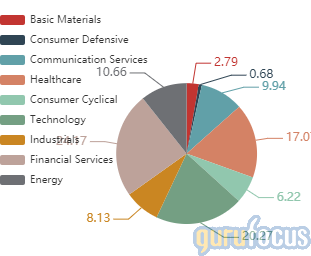

Dodge & Cox's $123.65 billion equity portfolio, which was composed of 180 stocks as of the end of the second quarter, is largely invested in the financial services and technology sectors.

According to GuruFocus data, the Dodge & Cox Stock Fund posted a return of -7.08% in 2018, slightly underperforming the S&P 500 Index's -4.75% return.

Disclosure: No positions.

Read more here:

Bed Bath & Beyond Shares Soar After Target's Mark Tritton Named CEO

3 Employment Services Companies to Consider Following Strong Jobs Report

Domino's Shares Cool on Disappointing Results, Lower Guidance

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.