Does Atrium Mortgage Investment Corporation (TSE:AI) Have A Place In Your Dividend Stock Portfolio?

Is Atrium Mortgage Investment Corporation (TSE:AI) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

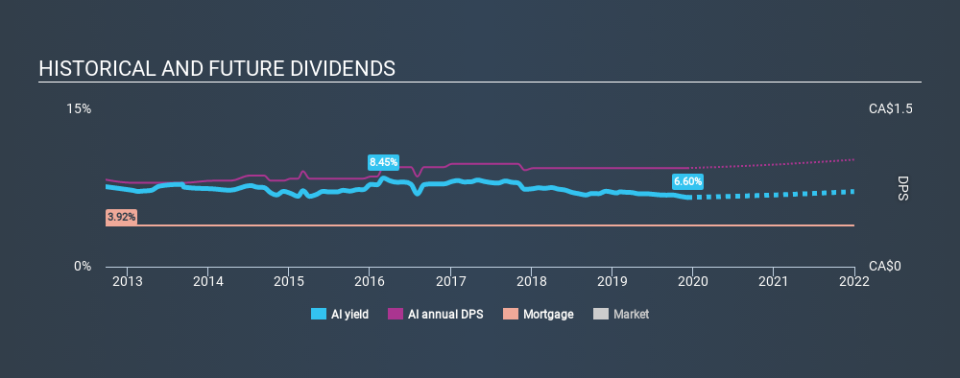

With a seven-year payment history and a 6.6% yield, many investors probably find Atrium Mortgage Investment intriguing. We'd agree the yield does look enticing. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Atrium Mortgage Investment!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 92% of Atrium Mortgage Investment's profits were paid out as dividends in the last 12 months. With a payout ratio this high, we'd say its dividend is not well covered by earnings. This may be fine if earnings are growing, but it might not take much of a downturn for the dividend to come under pressure.

Consider getting our latest analysis on Atrium Mortgage Investment's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the data, we can see that Atrium Mortgage Investment has been paying a dividend for the past seven years. The dividend has been quite stable over the past seven years, which is great to see - although we usually like to see the dividend maintained for a decade before giving it full marks, though. During the past seven-year period, the first annual payment was CA$0.83 in 2012, compared to CA$0.94 last year. Dividends per share have grown at approximately 1.8% per year over this time.

It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Earnings have grown at around 2.7% a year for the past five years, which is better than seeing them shrink! This level of earnings growth is low, and the company is paying out 92% of its profit. As they say in finance, 'past performance is not indicative of future performance', but we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

We'd also point out that Atrium Mortgage Investment issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

To summarise, shareholders should always check that Atrium Mortgage Investment's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Atrium Mortgage Investment is paying out a larger percentage of its profit than we're comfortable with. Second, earnings growth has been ordinary, and its history of dividend payments is shorter than we'd like. To conclude, we've spotted a couple of potential concerns with Atrium Mortgage Investment that may make it less than ideal candidate for dividend investors.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 3 analysts we track are forecasting for Atrium Mortgage Investment for free with public analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.