Does Changhong Jiahua Holdings (HKG:3991) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Changhong Jiahua Holdings Limited (HKG:3991) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Changhong Jiahua Holdings

What Is Changhong Jiahua Holdings's Net Debt?

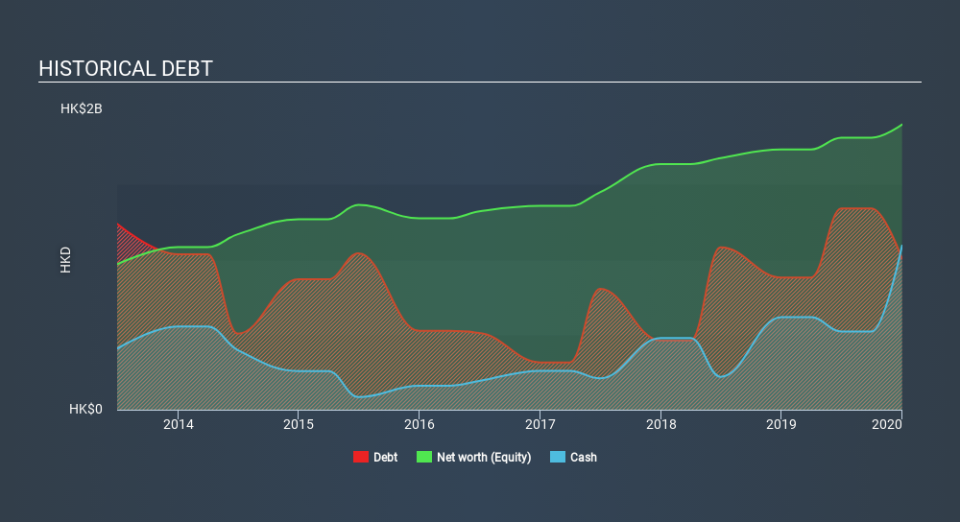

As you can see below, at the end of December 2019, Changhong Jiahua Holdings had HK$1.01b of debt, up from HK$880.5m a year ago. Click the image for more detail. But on the other hand it also has HK$1.09b in cash, leading to a HK$87.5m net cash position.

How Healthy Is Changhong Jiahua Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Changhong Jiahua Holdings had liabilities of HK$5.38b due within 12 months and liabilities of HK$2.03m due beyond that. Offsetting this, it had HK$1.09b in cash and HK$2.11b in receivables that were due within 12 months. So it has liabilities totalling HK$2.18b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's HK$1.98b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Given that Changhong Jiahua Holdings has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

One way Changhong Jiahua Holdings could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Changhong Jiahua Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Changhong Jiahua Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Changhong Jiahua Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

Although Changhong Jiahua Holdings's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of HK$87.5m. And we liked the look of last year's 18% year-on-year EBIT growth. Despite the cash, we do find Changhong Jiahua Holdings's conversion of EBIT to free cash flow concerning, so we're not particularly comfortable with the stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Changhong Jiahua Holdings (including 1 which is doesn't sit too well with us) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.