Does Columbia Sportswear (NASDAQ:COLM) Deserve A Spot On Your Watchlist?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Columbia Sportswear (NASDAQ:COLM). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Columbia Sportswear

Columbia Sportswear's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Columbia Sportswear has grown EPS by 19% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

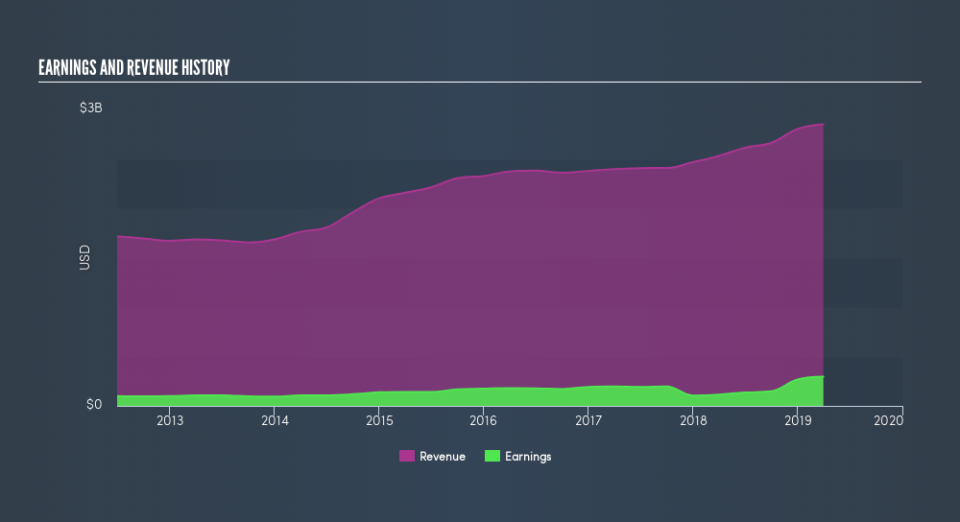

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Columbia Sportswear is growing revenues, and EBIT margins improved by 2.3 percentage points to 13%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Columbia Sportswear's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Columbia Sportswear Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Columbia Sportswear insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 57%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. At the current share price, that insider holding is worth a whopping US$3.7b. That means they have plenty of their own capital riding on the performance of the business!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between US$4.0b and US$12b, like Columbia Sportswear, the median CEO pay is around US$7.1m.

The Columbia Sportswear CEO received total compensation of just US$3.3m in the year to December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Columbia Sportswear Worth Keeping An Eye On?

For growth investors like me, Columbia Sportswear's raw rate of earnings growth is a beacon in the night. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Each to their own, but I think all this makes Columbia Sportswear look rather interesting indeed. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Columbia Sportswear. You might benefit from giving it a glance today.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.