Does Dynacor Gold Mines (TSE:DNG) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Dynacor Gold Mines (TSE:DNG), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Dynacor Gold Mines

Dynacor Gold Mines's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Dynacor Gold Mines has grown EPS by 8.3% per year. That's a pretty good rate, if the company can sustain it.

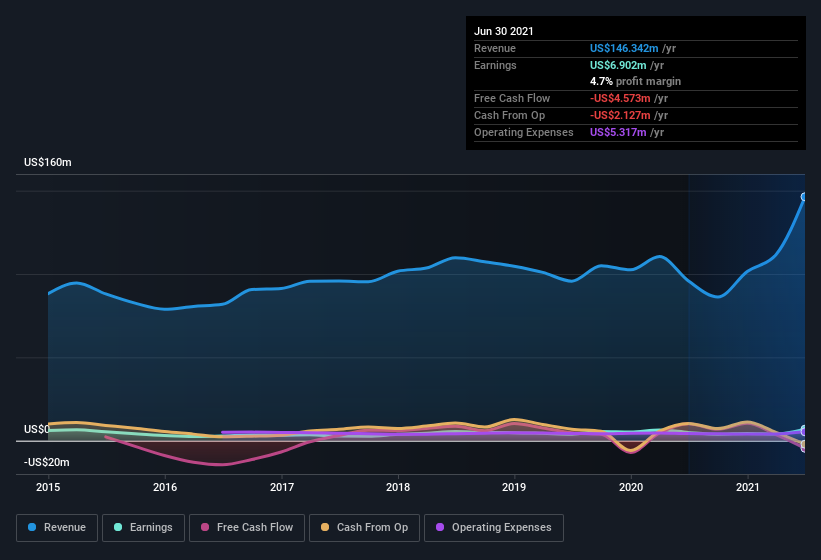

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Dynacor Gold Mines maintained stable EBIT margins over the last year, all while growing revenue 53% to US$146m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Dynacor Gold Mines isn't a huge company, given its market capitalization of CA$107m. That makes it extra important to check on its balance sheet strength.

Are Dynacor Gold Mines Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Insiders both bought and sold Dynacor Gold Mines shares in the last year, but the good news is they spent US$18k more buying than they netted selling. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. It is also worth noting that it was President Jean Martineau who made the biggest single purchase, worth CA$37k, paying CA$1.83 per share.

Does Dynacor Gold Mines Deserve A Spot On Your Watchlist?

One positive for Dynacor Gold Mines is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Dynacor Gold Mines seems free from that morose affliction. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. Still, you should learn about the 3 warning signs we've spotted with Dynacor Gold Mines (including 1 which shouldn't be ignored) .

As a growth investor I do like to see insider buying. But Dynacor Gold Mines isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.