Does FFI Holdings (ASX:FFI) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, FFI Holdings Limited (ASX:FFI) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for FFI Holdings

What Is FFI Holdings's Net Debt?

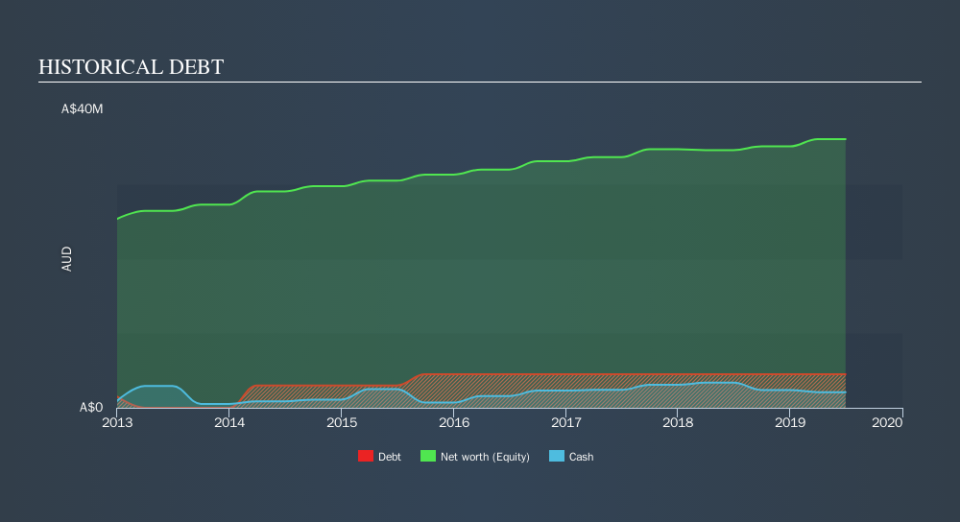

The chart below, which you can click on for greater detail, shows that FFI Holdings had AU$4.50m in debt in June 2019; about the same as the year before. However, it does have AU$2.10m in cash offsetting this, leading to net debt of about AU$2.40m.

A Look At FFI Holdings's Liabilities

According to the last reported balance sheet, FFI Holdings had liabilities of AU$8.98m due within 12 months, and liabilities of AU$5.48m due beyond 12 months. Offsetting this, it had AU$2.10m in cash and AU$5.60m in receivables that were due within 12 months. So its liabilities total AU$6.76m more than the combination of its cash and short-term receivables.

Given FFI Holdings has a market capitalization of AU$50.0m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

FFI Holdings has a low net debt to EBITDA ratio of only 0.48. And its EBIT easily covers its interest expense, being 25.5 times the size. So we're pretty relaxed about its super-conservative use of debt. And we also note warmly that FFI Holdings grew its EBIT by 18% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since FFI Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, FFI Holdings recorded free cash flow worth 51% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, FFI Holdings's impressive interest cover implies it has the upper hand on its debt. And that's just the beginning of the good news since its net debt to EBITDA is also very heartening. Zooming out, FFI Holdings seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that FFI Holdings insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.