Does Hostess Brands Inc’s (NASDAQ:TWNK) CEO Salary Compared Well With Others?

Bill Toler is the CEO of Hostess Brands Inc (NASDAQ:TWNK), which has recently grown to a market capitalization of $1.94B. Recognizing whether CEO incentives are aligned with shareholders is a crucial part of investing. Incentives can be in the form of compensation, which should always be structured in a way that promotes value-creation to shareholders. Today we will assess Toler’s pay and compare this to the company’s performance over the same period, as well as measure it against other US CEOs leading companies of similar size and profitability. See our latest analysis for Hostess Brands

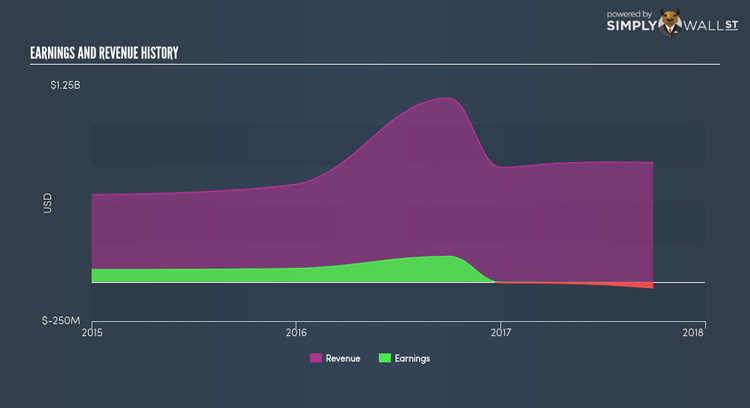

What has been the trend in TWNK’s earnings?

Earnings is a powerful indication of TWNK’s ability to invest shareholders’ funds and generate returns. Therefore I will use earnings as a proxy of Toler’s performance in the past year. Over the last year TWNK released negative earnings of -$37.6M , compared to the previous year’s positive earnings. Moreover, TWNK hasn’t always been loss-making, with an average EPS of $3.53 over the past five years. During times of negative earnings, the company may be facing a period of reinvestment and growth, or it can be an indication of some headwind. In any case, CEO compensation should represent the current condition of the business. From the latest report, Toler’s total compensation more than doubled, to $1,526,655 .

What’s a reasonable CEO compensation?

Even though there is no cookie-cutter approach, since compensation should be tailored to the specific company and market, we can estimate a high-level yardstick to see if TWNK deviates substantially from its peers. This exercise can help shareholders ask the right question about Toler’s incentive alignment. Generally, a US small-cap has a value of $1B, produces earnings of $96M, and pays its CEO circa $2.7M per annum. Typically I would use earnings and market cap to account for variations in performance, however, TWNK’s negative earnings lower the usefulness of my formula. Analyzing the range of remuneration for small-cap executives, it seems like Toler is paid aptly compared to those in similar-sized companies. Overall, though TWNK is loss-making, it seems like the CEO’s pay is appropriate.

What this means for you:

Are you a shareholder? You can breathe easy knowing that shareholder funds aren’t being used to overpay TWNK’s CEO. However, on the flipside, you should ask whether Toler is appropriately remunerated on the basis of retention. Its important for shareholders to be active in voting governance decisions, as board members are only representatives of investors’ voices. To find out more about TWNK’s governance, look through our infographic report of the company’s board and management.

Are you a potential investor? Although remuneration can be a useful gauge of whether Toler’s incentives are well-aligned with TWNK’s shareholders, it is certainly not sufficient to base your investment decision solely on this factor. Whether the company is fundamentally strong depends on TWNK’s financial health and its future outlook. To research more about these fundamentals, I recommend you check out our simple infographic report on TWNK’s financial metrics.

PS. If you are not interested in Hostess Brands anymore, you can use our free platform to see my list of over 50 sustainable companies producing great returns.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.