How Does Investing In African Energy Resources Limited (ASX:AFR) Impact Your Portfolio?

If you are looking to invest in African Energy Resources Limited’s (ASX:AFR), or currently own the stock, then you need to understand its beta in order to understand how it can affect the risk of your portfolio. Broadly speaking, there are two types of risk you should consider when investing in stocks such as AFR. The first risk to think about is company-specific, which can be diversified away by investing in other companies in order to lower your exposure to one particular stock. The second type is market risk, one that you cannot diversify away, since it arises from macroeconomic factors which directly affects all the stocks in the market.

Different characteristics of a stock expose it to various levels of market risk. The most widely used metric to quantify a stock's market risk is beta, and the market as a whole represents a beta of one. A stock with a beta greater than one is expected to exhibit higher volatility resulting from market-wide shocks compared to one with a beta below one.

Check out our latest analysis for African Energy Resources

What is AFR’s market risk?

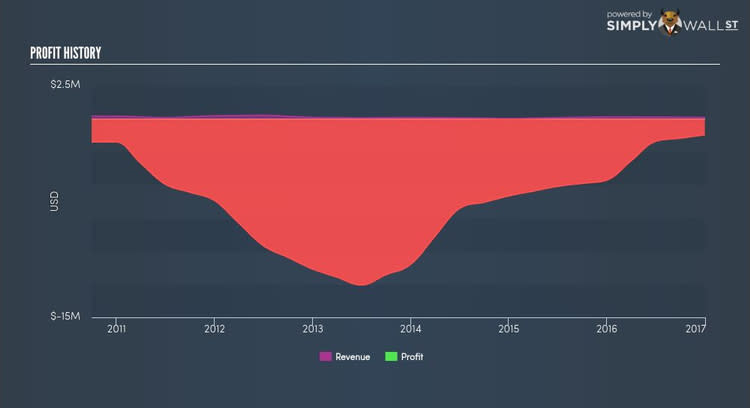

With a beta of 1.21, African Energy Resources is a stock that tends to experience more gains than the market during a growth phase and also a bigger reduction in value compared to the market during a broad downturn. Based on this beta value, AFR will help diversify your portfolio, if it currently comprises of low-beta stocks. This will be beneficial for portfolio returns, in particular, when current market sentiment is positive.

Does AFR's size and industry impact the expected beta?

AFR, with its market capitalisation of AUD $31.33M, is a small-cap stock, which generally have higher beta than similar companies of larger size. Furthermore, the company operates in the energy industry, which has been found to have high sensitivity to market-wide shocks. Therefore, investors may expect high beta associated with small companies, as well as those operating in the X industry, relative to those more well-established firms in a more defensive industry. This is consistent with AFR’s individual beta value we discussed above. Next, we will examine the fundamental factors which can cause cyclicality in the stock.

How AFR's assets could affect its beta

During times of economic downturn, low demand may cause companies to readjust production of their goods and services. It is more difficult for companies to lower their cost, if the majority of these costs are generated by fixed assets. Therefore, this is a type of risk which is associated with higher beta. I test AFR’s ratio of fixed assets to total assets in order to determine how high the risk is associated with this type of constraint. Given a fixed to total assets ratio of over 30%, AFR seems to be a company which invests a big chunk of its capital on assets that cannot be scaled down on short-notice. As a result, this aspect of AFR indicates a higher beta than a similar size company with a lower portion of fixed assets on their balance sheet. This is consistent with is current beta value which also indicates high volatility.

What this means for you:

Are you a shareholder? You could benefit from higher returns from AFR during times of economic growth. Its higher fixed cost isn’t a major concern given margins are covered with high consumer demand. However, in times of a downturn, it may be safe to look at a more defensive stock which can cushion the impact of lower demand.

Are you a potential investor? Before you buy AFR, you should factor how your portfolio currently moves with the wider market, and where we are in the economic cycle. This stock could be an outperformer during times of growth, and it may be worth taking a deeper dive into the fundamentals to crystalize your thoughts on AFR.

Beta is one aspect of your portfolio construction to consider when holding or entering into a stock. But it is certainly not the only factor. Take a look at our most recent infographic report on African Energy Resources for a more in-depth analysis of the stock to help you make a well-informed investment decision. But if you are not interested in African Energy Resources anymore, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.