Does Magna International Inc’s (TSX:MG) Debt Level Pose A Serious Problem?

With a market capitalization of CAD CA$25.80B, Magna International Inc (TSX:MG) falls in the category of stocks popularly identified as large-caps. These are established companies that attract investors due to diversified revenue streams and ability to enhance total returns through dividends. However, another important aspect of investing in large caps is its financial health. There are always disruptions which destabilize an existing industry, and although large-caps are hard to knock down, it is useful to understand its level of resilience. Thus, it becomes utmost important for an investor to test a company’s resilience for such contingencies. In simple terms, I believe these three small calculations tell most of the story you need to know. See our latest analysis for MG

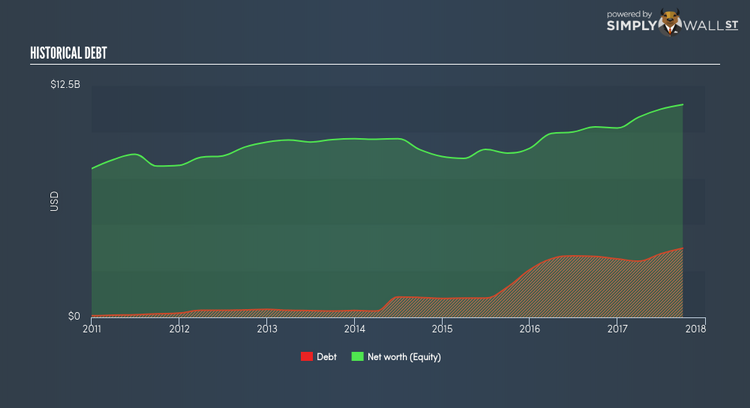

Does MG face the risk of succumbing to its debt-load?

What is considered a high debt-to-equity ratio differs depending on the industry, because some industries tend to utilize more debt financing than others. Generally, large-cap stocks are considered financially healthy if its ratio is below 40%. In the case of MG, the debt-to-equity ratio is 32.53%, which means the risk of facing a debt-overhang is very low. While debt-to-equity ratio has several factors at play, an easier way to check whether MG’s leverage is at a sustainable level is to check its ability to service the debt. A company generating earnings (EBIT) at least three times its interest payments is considered financially sound. In MG’s case, its interest is excessively covered by its earnings as the ratio sits at 39.66x. This means lenders may be inclined to lend more money to the company, as it is seen as safe in terms of payback.

Does MG generate an acceptable amount of cash through operations?

A basic way to evaluate MG’s debt management is to see whether the cash flow generated from the business is at a relatively high level compared to the debt capital invested. This also assesses MG’s debt repayment capacity, which is not a big concern for a large company. In the case of MG, operating cash flow turned out to be 1x its debt level over the past twelve months. This is a good sign, as over half of MG’s near term debt can be covered by its day-to-day cash income, which reduces its riskiness to its debtholders.

Next Steps:

Are you a shareholder? MG’s debt level is appropriate for a company its size. Furthermore, it is able to generate sufficient cash flow coverage, meaning it is able to put its debt in good use. Given that MG’s financial position may change over time, I recommend researching market expectations for MG’s future growth on our free analysis platform.

Are you a potential investor? Although investors should analyse the serviceability of debt, it shouldn’t be viewed in isolation of other factors. Ultimately, debt financing is an important source of funding for companies seeking to grow through new projects and investments. This is why I recommend potential investors to examine MG’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.