Does Micron Technology (NASDAQ:MU) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Micron Technology, Inc. (NASDAQ:MU) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Micron Technology

How Much Debt Does Micron Technology Carry?

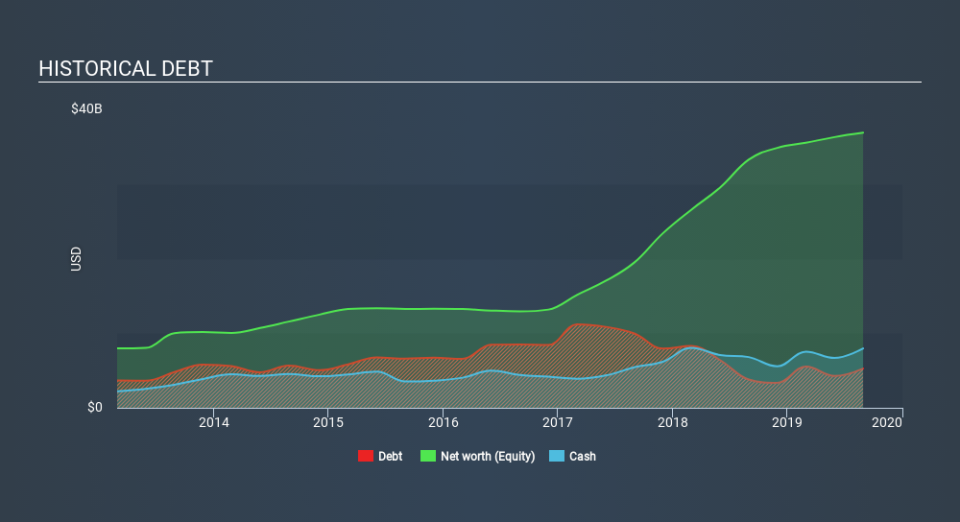

You can click the graphic below for the historical numbers, but it shows that as of August 2019 Micron Technology had US$5.26b of debt, an increase on US$4.64b, over one year. But on the other hand it also has US$7.96b in cash, leading to a US$2.70b net cash position.

How Strong Is Micron Technology's Balance Sheet?

The latest balance sheet data shows that Micron Technology had liabilities of US$6.39b due within a year, and liabilities of US$5.63b falling due after that. Offsetting these obligations, it had cash of US$7.96b as well as receivables valued at US$3.19b due within 12 months. So it has liabilities totalling US$871.0m more than its cash and near-term receivables, combined.

Having regard to Micron Technology's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$51.4b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Micron Technology boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for Micron Technology if management cannot prevent a repeat of the 50% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Micron Technology's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Micron Technology has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Micron Technology produced sturdy free cash flow equating to 54% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

We could understand if investors are concerned about Micron Technology's liabilities, but we can be reassured by the fact it has has net cash of US$2.70b. So we don't have any problem with Micron Technology's use of debt. We'd be motivated to research the stock further if we found out that Micron Technology insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.