What does The Mosaic Company’s (NYSE:MOS) Balance Sheet Tell Us Abouts Its Future?

The Mosaic Company (NYSE:MOS), a large-cap worth $10.49B, comes to mind for investors seeking a strong and reliable stock investment. Risk-averse investors who are attracted to diversified streams of revenue and strong capital returns tend to seek out these large companies. But, the health of the financials determines whether the company continues to succeed. I will provide an overview of Mosaic’s financial liquidity and leverage to give you an idea of Mosaic’s position to take advantage of potential acquisitions or comfortably endure future downturns. Note that this information is centred entirely on financial health and is a high-level overview, so I encourage you to look further into MOS here. View our latest analysis for Mosaic

Does MOS produce enough cash relative to debt?

Over the past year, MOS has maintained its debt levels at around $3,818.2M made up of current and long term debt. At this current level of debt, MOS currently has $673.1M remaining in cash and short-term investments , ready to deploy into the business. Additionally, MOS has generated cash from operations of $1,266.1M during the same period of time, resulting in an operating cash to total debt ratio of 33.16%, meaning that MOS’s current level of operating cash is high enough to cover debt. This ratio can also be interpreted as a measure of efficiency as an alternative to return on assets. In MOS’s case, it is able to generate 0.33x cash from its debt capital.

Does MOS’s liquid assets cover its short-term commitments?

At the current liabilities level of $1,476.8M liabilities, it appears that the company has been able to meet these commitments with a current assets level of $3,057.7M, leading to a 2.07x current account ratio. For Chemicals companies, this ratio is within a sensible range since there’s sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Can MOS service its debt comfortably?

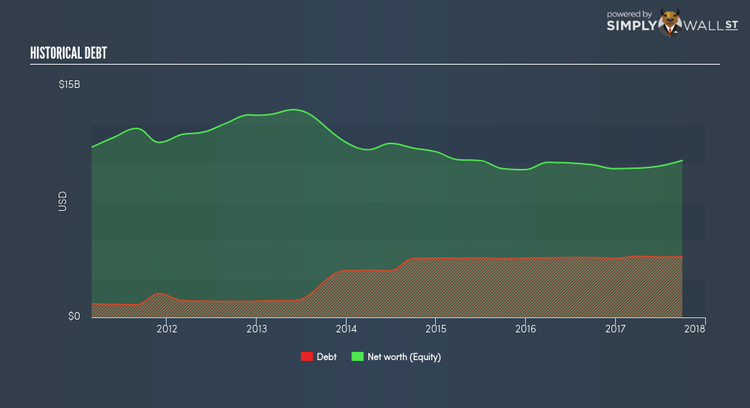

MOS’s level of debt is appropriate relative to its total equity, at 38.55%. MOS is not taking on too much debt commitment, which may be constraining for future growth. We can check to see whether MOS is able to meet its debt obligations by looking at the net interest coverage ratio. A company generating earnings after interest and tax at least three times its net interest payments is considered financially sound. In MOS’s case, the ratio of 3.86x suggests that interest is well-covered. High interest coverage serves as an indication of the safety of a company, which highlights why many large organisations like MOS are considered a risk-averse investment.

Next Steps:

MOS’s high cash coverage and appropriate debt levels indicate its ability to utilise its borrowings efficiently in order to generate ample cash flow. In addition to this, the company exhibits proper management of current assets and upcoming liabilities. I admit this is a fairly basic analysis for MOS’s financial health. Other important fundamentals need to be considered alongside. I suggest you continue to research Mosaic to get a more holistic view of the stock by looking at:

1. Future Outlook: What are well-informed industry analysts predicting for MOS’s future growth? Take a look at our free research report of analyst consensus for MOS’s outlook.

2. Valuation: What is MOS worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether MOS is currently mispriced by the market.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.