What does Nagambie Resources Limited’s (ASX:NAG) Balance Sheet Tell Us Abouts Its Future?

Nagambie Resources Limited (ASX:NAG) is a small-cap stock with a market capitalization of AUD A$17.77M. While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Why is it important? A major downturn in the energy industry has resulted in over 150 companies going bankrupt and has put more than 100 on the verge of a collapse, primarily due to excessive debt. Here are few basic financial health checks to judge whether a company fits the bill or there is an additional risk which you should consider before taking the plunge. See our latest analysis for NAG

Does NAG generate an acceptable amount of cash through operations?

Unxpected adverse events, such as natural disasters and wars, can be a true test of a company’s capacity to meet its obligations. Furthermore, failure to service debt can hurt its reputation, making funding expensive in the future. We can test the impact of these adverse events by looking at whether cash from its current operations can pay back its current debt obligations. In the case of NAG, operating cash flow turned out to be -0.59x its debt level over the past twelve months. This means what NAG can generate on an annual basis, which is currently a negative value, does not cover what it actually owes its debtors in the near term. This raises a red flag, looking at NAG’s operations at this point in time.

Can NAG meet its short-term obligations with the cash in hand?

In addition to debtholders, a company must be able to pay its bills and salaries to keep the business running. During times of unfavourable events, NAG could be required to liquidate some of its assets to meet these upcoming payments, as cash flow from operations is hindered. We should examine if the company’s cash and short-term investment levels match its current liabilities. Our analysis shows that NAG is unable to meet all of its upcoming commitments with its cash and other short-term assets. While this is not abnormal for companies, as their cash is better invested in the business or returned to investors than lying around, it does bring about some concerns should any unfavourable circumstances arise.

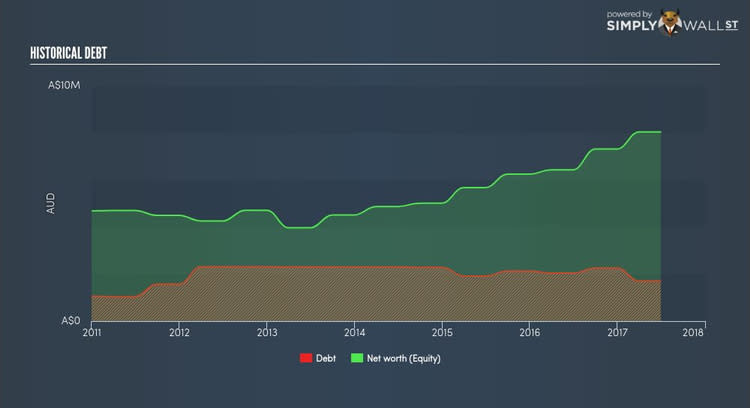

Is NAG’s level of debt at an acceptable level?

While ideally the debt-to equity ratio of a financially healthy company should be less than 40%, several factors such as industry life-cycle and economic conditions can result in a company raising a significant amount of debt. In the case of NAG, the debt-to-equity ratio is 21.20%, which indicates that its debt is at an acceptable level.

Next Steps:

Are you a shareholder? NAG’s low debt is also met with low coverage. This indicates room for improvement as its cash flow covers less than a quarter of its borrowings, which means its operating efficiency could be better. Furthermore, the company may struggle to meet its near term liabilities should an adverse event occur. Given that its financial position may change. You should always be researching market expectations for NAG’s future growth on our free analysis platform.

Are you a potential investor? NAG appears to have a sensible level of debt, which means there’s still some headroom to grow debt funding. But its current cash flow coverage of existing debt, along with its low liquidity, is concerning. However, keep in mind that this is a point-in-time analysis, and today’s performance may not be representative of NAG’s track record. As a following step, you should take a look at NAG’s past performance analysis on our free platform to conclude on NAG’s financial health.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.